Pricing of risk kicks bucket in record central-bank absurdity.

Pricing of risk kicks bucket in record central-bank absurdity.

As the days pass, the perverse effects of central bank policies on the financial markets are getting more and more amazing. This includes the record-setting nuttiness now reigning in the European bond market, compared to the mere semi-nuttiness in the US bond market.

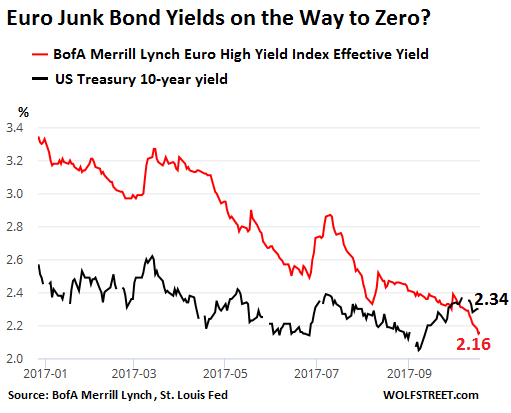

The 10-year yield of US Treasury Securities closed at 2.34% yesterday and at 2.33% today. This is low by historical standards. It’s barely above the rate of consumer price inflation as measured by CPI, which was 2.2% in September. This means that coupon payments barely make up for the loss of purchasing power. If inflation ticks up just a little, bondholders will be left in the hole. And a yield this low doesn’t compensate bondholders for any other risks, including duration risk, which can be significant. In other words, this is a bad deal.

But in this strange world, it looks practically sane, compared to the Draghi-engineered negative-yield absurdity that has overtaken the Eurozone, where the average yield of euro junk bonds – the riskiest bonds out there – dropped to 2.16%.

This chart, based on the BofA Merrill Lynch Euro High Yield Index via the St. Louis Fed, shows how the average euro junk-bond yield (red line) has plunged so far this year, on the way to what? Zero? The 10-year US Treasury yield (black line) has started rising in past weeks and, in late September rose above the euro junk bond yield for the first time ever:

This post was published at Wolf Street on Oct 19, 2017.

Follow on Twitter

Follow on Twitter

Recent Comments