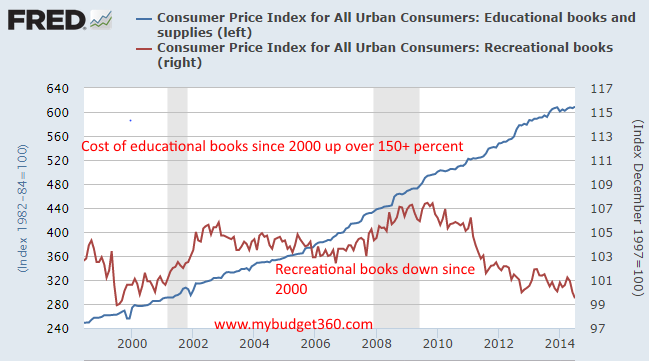

There are many reasons why college costs are soaring even well beyond the regular rate of inflation. Schools are adding immense amenities to attract students. Student debt backed by the government allows schools to push prices higher since students simply go into deeper debt with little analysis on ability to pay at a later date. Similar to hospital charging outrageous prices for a standard Aspirin, book publishers realize that they can get away with charging more for textbooks as well. Any college student can tell you that the cost of a college text can eat deep into your budget. Many science books cost hundreds of dollars. Publishers quickly realized years ago that savvy students could photocopy and pass books around. The way around this? Requiring students to purchase access codes in conjunction with the book virtually forced students to always pay market prices for access to course content. So it should come as no surprise to you that since 2000, the cost of educational books has soared while the cost of recreational books has actually fallen.

There are many reasons why college costs are soaring even well beyond the regular rate of inflation. Schools are adding immense amenities to attract students. Student debt backed by the government allows schools to push prices higher since students simply go into deeper debt with little analysis on ability to pay at a later date. Similar to hospital charging outrageous prices for a standard Aspirin, book publishers realize that they can get away with charging more for textbooks as well. Any college student can tell you that the cost of a college text can eat deep into your budget. Many science books cost hundreds of dollars. Publishers quickly realized years ago that savvy students could photocopy and pass books around. The way around this? Requiring students to purchase access codes in conjunction with the book virtually forced students to always pay market prices for access to course content. So it should come as no surprise to you that since 2000, the cost of educational books has soared while the cost of recreational books has actually fallen.

Reading inflation

College books are expensive. Yet the cost of going to college has absolutely soared since 2000. In line with the rising cost of higher education students have gone deeper and deeper into debt. Financial aid will first pay off tuition, fees, and other mandatory charges but many students will take a small or large amount more to cover living expenses including books and other materials. Since the debt is there, it is not surprising that publishers have taken advantage of this easy debt machinery.

Many college students are living on Ramen and water yet somehow, are able to drop hundreds of dollars on course books. I would venture to say that a piece of that student debt pie is allocated to purchase books each semester. If you think prices have not gone up for educational books take a look at this:

This post was published at MyBudget360 on September 9, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments