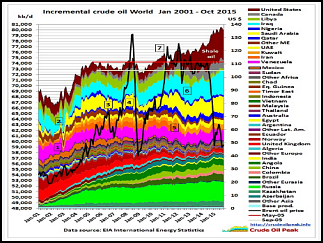

Outside the US and Canada, the world is in peak oil mode for more than 10 years now. There are many events which have brought about this bumpy production plateau. The sequence of these events has never allowed oil production to grow much over a longer time. We have seen the predicted negative feedback loops when oil production gets harder and more expensive. The end result of this phase is a weakened financial system with more debt and many government budgets in deficit.

Outside the US and Canada, the world is in peak oil mode for more than 10 years now. There are many events which have brought about this bumpy production plateau. The sequence of these events has never allowed oil production to grow much over a longer time. We have seen the predicted negative feedback loops when oil production gets harder and more expensive. The end result of this phase is a weakened financial system with more debt and many government budgets in deficit.

The response to peaking conventional oil production was money printing and unconventional oil. In typical US style huge amounts of material, equipment and labour were mobilised to extract shale oil from tight rocks, a last resort after US production had declined since 1970. Skilfully designed propaganda of the oil industry employed the media to spread the news of an energy revolution. The objective of becoming independent of oil imports and thus beat OPEC excited the whole US nation. But it was overdone. The light shale oil – not your average crude oil – could not all be absorbed by US refineries and ended up in inventories. In a strange way, market forces did not work.

Later than expected US shale oil is peaking now. The latest case is the Chesapeake stock slump. If oil prices stay low for a longer time, oil production will ultimately go down and 2015/16 may be the global peak. Price spikes will be certain, further damaging the financial system. And then we have the Middle East. The sinkhole around Syria is widening month by month. There is no way a revived US shale oil industry could compensate for any losses when fights start in the Persian Gulf.

This post was published at SRSrocco Report on February 15, 2016.

Follow on Twitter

Follow on Twitter

Recent Comments