On morning of 17 November, while Western investors were sleeping, China opened the door to its investment world. On that day China began two way trading between the Shanghai and Hong Kong stock exchanges. This development essentially opened the Chinese stock market to investors around the world through Shanghai-Hong Kong Stock Connect. They said to investors around the world, ‘Welcome, just bring your money and come right in.’

On morning of 17 November, while Western investors were sleeping, China opened the door to its investment world. On that day China began two way trading between the Shanghai and Hong Kong stock exchanges. This development essentially opened the Chinese stock market to investors around the world through Shanghai-Hong Kong Stock Connect. They said to investors around the world, ‘Welcome, just bring your money and come right in.’

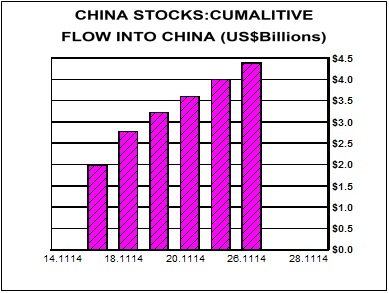

Investors would be well advised to be aware of the money flowing into the Chinese stock market, and possible ramifications of that money movement. Money is like water flowing across the earth, it fills in the low spot. To foreign investors, and in particular dollar-based institutional funds, the Chinese stock market is a ‘low spot’ to be filled in with money. Foreign investors will fill that ‘low spot’ with their money. Institutional money managers cannot ignore the most important economy in the world, and one destined to be the largest. As the chart at right portrays, the cumulative dollar flow into China’s stock market is off to a good start. At present the daily limitation on investment money inflow is 13 billion Yuan, or roughly $2.1 billion, per day. Actual money flows have been below that limit, but it is just the first week of the rest of time. Note especially that we only have a week of data, and the discussion that follows is about trends that will unfold over time.

This post was published at Gold-Eagle on November 24, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments