That didn’t take long. The Fed’s unpaid PR flack at the Wall Street Journal, Jon Hilsenrath, was out with hardly an hour to spare after the August jobs report – relaying word from the Eccles Building that ZIRP is in no danger of being rescinded early.

That didn’t take long. The Fed’s unpaid PR flack at the Wall Street Journal, Jon Hilsenrath, was out with hardly an hour to spare after the August jobs report – relaying word from the Eccles Building that ZIRP is in no danger of being rescinded early.

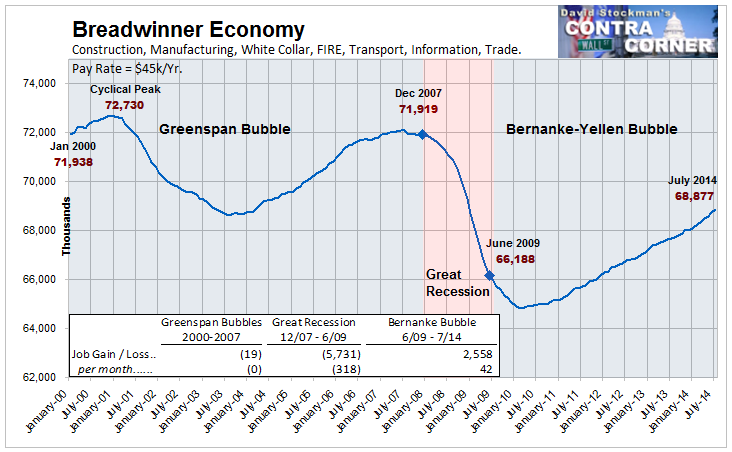

When at the July meeting our monetary plumbers saw ‘significant underutilization of labor resources’, which is code for continued zero interest rates, they were looking at an unemployment rate in June of 6.1%. So according to Hilsenrath, today’s weakish jobs report is good news for Wall Street’s free money crowd.

The fact that unemployment hasn’t fallen since the July meeting -and that job growth slowed in August – suggests Fed officials won’t make big changes to their policy statement and the signal they’re sending about rates when they meet Sept. 16 and 17.

Indeed, the Fed’s other unpaid spokesman, Steve Leisman at CNBC, had already made the point within minutes of the release. ZIRP will now last until next July, he opined. The danger that money market rates would rise, to say 40 bps, as early as March has been alleviated by the ‘disappointing’ 142,000 print for August. Whew!

This post was published at David Stockmans Contra Corner on September 5, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments