As we focus on the most recent moves of the Federal Reserve, it’s easy to miss the bigger picture. The Fed has been trying to move toward an interest rate ‘normalization’ program for more than a year, since nudging rates up .25 points in Dec. 2015.

As we focus on the most recent moves of the Federal Reserve, it’s easy to miss the bigger picture. The Fed has been trying to move toward an interest rate ‘normalization’ program for more than a year, since nudging rates up .25 points in Dec. 2015.

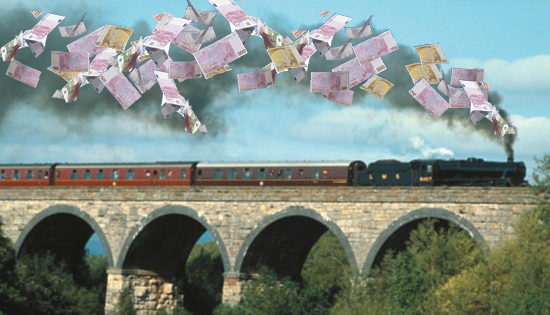

Although it remains to be seen whether the two interest rate hikes last December and March signal a rocket launch or a sputtering firecracker, the central bank at least wants to give the appearance of tightening. The Fed has also launched some trial balloons with talk of shrinking its bloated balance sheet.

But some other central banks around the world aren’t even making a pretense of ‘normalization.’ For instance, Bank of Japan Governor Haruhiko Kuroda said Monday the central bank remains committed to maintaining its massive monetary stimulus program.

Last fall, the BOJ launched a program to hold short-term interest rates in negative territory at minus 0.1%. The bank also seeks to keep the Japanese 10-year bond yield at about 0% through aggressive asset purchases.

Kuroda’s comments echoed statements he made in March. Japanese central planners remain obsessed with hitting the 2% target inflation rate, as Kuroda stated at a Reuters Newsmaker event last month:

This post was published at Schiffgold on APRIL 10, 2017.

Follow on Twitter

Follow on Twitter

Recent Comments