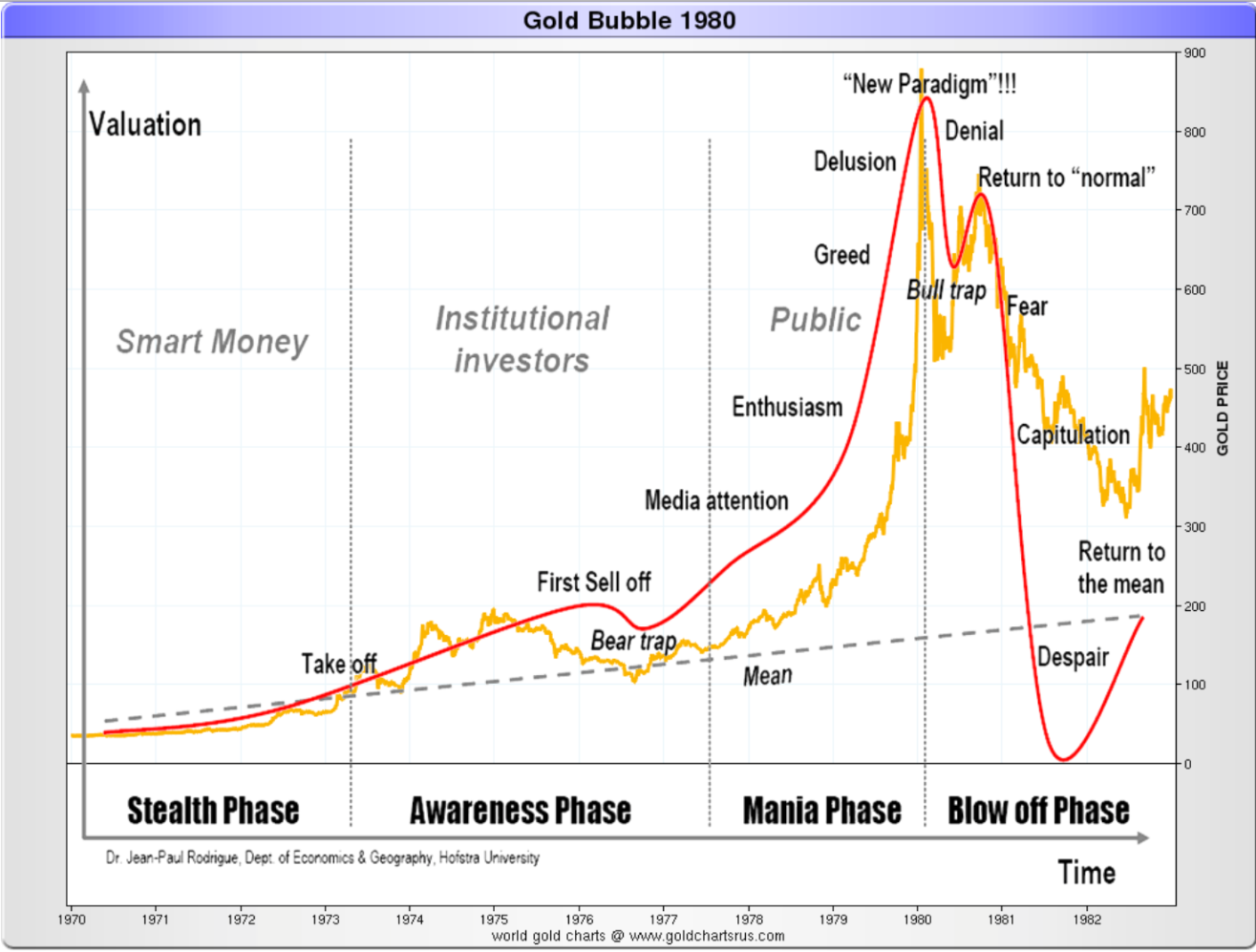

If we look at a graph of the ’70s gold bull market (graph #1) and superimpose the typical bubble shape, we can clearly see that it closely fits the bubble model but stopping short of a Total Despair Phase. Those like me who lived through the euphoria of the ’70s and the capitulation of the ’90s, I am sure, will agree with the description of the gold market as a bubble. Looking at the graph below it doesn’t look like gold was in a Despair Phase but I remember well in the ’90s statements by many in the financial industry that gold was a relic of the past, a useless metal and that its fundamental value was zero, predicting lower prices of about US$50 and some even zero. These statements are very characteristic of a major bottom.

If we look at a graph of the ’70s gold bull market (graph #1) and superimpose the typical bubble shape, we can clearly see that it closely fits the bubble model but stopping short of a Total Despair Phase. Those like me who lived through the euphoria of the ’70s and the capitulation of the ’90s, I am sure, will agree with the description of the gold market as a bubble. Looking at the graph below it doesn’t look like gold was in a Despair Phase but I remember well in the ’90s statements by many in the financial industry that gold was a relic of the past, a useless metal and that its fundamental value was zero, predicting lower prices of about US$50 and some even zero. These statements are very characteristic of a major bottom.

Graph #1: Gold Bubble 1980

This post was published at Gold Broker on Nov 10, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments