You would think that the recent rise in home prices across Southern California would be enough to bring most homeowners into a positive equity position. However, we still have 1 out of 10 homeowners in a negative equity position. The total number of homes underwater in SoCal is estimated to be at 288,000 according to CoreLogic. This is a far cry from the 1.1 million underwater homes going back to 2009. Since that time many foreclosures have occurred and many homes have now shifted into the hands of investors. 288,000 is a large number of homes especially in a market with limited inventory. Now that we are entering into the slower fall selling season, you will likely see inventory pullback and buying demand slow down. Investor demand has pulled back dramatically already. Buying a home is a big deal and running the numbers on a crap shack is important in making sure you are seeing the bigger picture. There still seems to be this amnesia as to what happened only a few years ago. Millions of homeowners lost out in the supposedly safe investment vehicle of housing. Why? Because they took on too much debt and paid too much for a property. As prices soared in the last year, we are starting to see a deeper questioning of current values now that investors are pulling back and foreclosure resales make up a small portion of the market. Regular buyers did not push this market up. It was investors. Many regular households have been pushed into renting.

You would think that the recent rise in home prices across Southern California would be enough to bring most homeowners into a positive equity position. However, we still have 1 out of 10 homeowners in a negative equity position. The total number of homes underwater in SoCal is estimated to be at 288,000 according to CoreLogic. This is a far cry from the 1.1 million underwater homes going back to 2009. Since that time many foreclosures have occurred and many homes have now shifted into the hands of investors. 288,000 is a large number of homes especially in a market with limited inventory. Now that we are entering into the slower fall selling season, you will likely see inventory pullback and buying demand slow down. Investor demand has pulled back dramatically already. Buying a home is a big deal and running the numbers on a crap shack is important in making sure you are seeing the bigger picture. There still seems to be this amnesia as to what happened only a few years ago. Millions of homeowners lost out in the supposedly safe investment vehicle of housing. Why? Because they took on too much debt and paid too much for a property. As prices soared in the last year, we are starting to see a deeper questioning of current values now that investors are pulling back and foreclosure resales make up a small portion of the market. Regular buyers did not push this market up. It was investors. Many regular households have been pushed into renting.

Trend shift

If we look at a housing market and define ‘health’ via foreclosures, the current market appears to be reaching a new balance. Yet these trend shifts can be deceptive. Keep in mind that in 2007 foreclosure volume was still weak and year-over-year price increases still looked spectacular. Things turn around slowly in housing. Things are good until they aren’t.

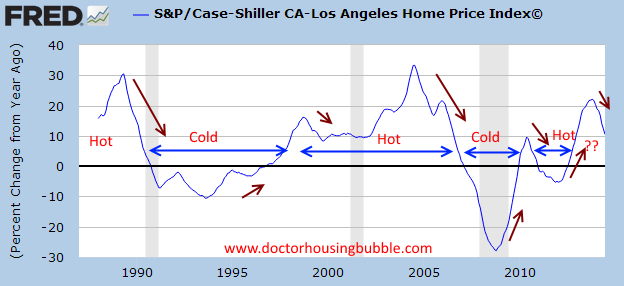

California has been boom and bust for a generation. Take a look at price increases for the LA and OC metro areas:

This post was published at Doctor Housing Bubble on September 3rd, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments