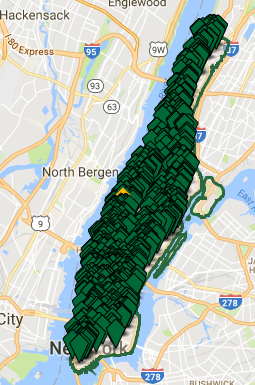

Now in San Francisco, New York, Boston, Chicago, Washington DC, and perhaps a city near you.

Now in San Francisco, New York, Boston, Chicago, Washington DC, and perhaps a city near you.

Averaged out across the US, asking rents for apartments still rose in November on a year-to-date basis, though more slowly than before, with the median asking rent for a one-bedroom up 1.8% and for a two-bedroom up 2.2%, according to Zumper’s National Rental Price Index. In July, rents had still been up over 4% year-to-date. Since then, they’ve started ticking down on a monthly basis. But averages can cover up more than they reveal.

On a city-by-city basis, a different scenario emerges, with rents going totally crazy in some la-la lands, as if it were still the summer of 2015, and in other cities, including the three most expensive rental markets in the US, rents are coming down hard.

In San Francisco, the number one most ludicrously expensive rental market in the US, rents have now sagged for the fifth month in a row. Asking rent for a median one-bedroom fell to $3,330. That’s still a lot of moolah: $40,000 a year for a small, very average apartment. But that’s down 9.3% from the peak of the rental bubble in October 2015.

The median asking rent for a two-bedroom dropped to $4,500. So $54,000 a year. That’s down 6.8% from a year ago, and down 10% from the October 2015 peak, when landlords were asking $5,000 a month, or $60,000 a year, according to Zumper. Back then, rents had soared 11% from the prior year. Those kinds of double-digit rent increases were common. Hence the local term, ‘Housing Crisis,’ when households with median incomes cannot afford to rent a median one-bedroom apartment.

This post was published at Wolf Street on December 1, 2016.

Follow on Twitter

Follow on Twitter

Recent Comments