The following video was published by RT on Oct 11, 2014

In this episode of the Keiser Report, Max Keiser and Stacy Herbert host a two part interview with award-winning film and television actor, Alec Baldwin, and comedian, actor, author and host of the Trews, Russell Brand, about revolution, the media, ultra low interest rates, cobblers and their little helpers. They also discuss whether or not Sean Hannity has the talent to be a ‘terrorist’ and Russell Brand gives his opinion on the role of Fox News.

Chinese Gold Demand Expert Koos Jansen

Koos Jansen is one of the world’s most renowned experts on Chinese gold demand. He’s honest and straightforward, which is certainly not something we are able to say about other global gold supply/demand experts, and this hour-long podcast is simply terrific. Please make the time to listen.

Koos Jansen is one of the world’s most renowned experts on Chinese gold demand. He’s honest and straightforward, which is certainly not something we are able to say about other global gold supply/demand experts, and this hour-long podcast is simply terrific. Please make the time to listen.

Here’s just one example of what makes Koos great and why this interview is so worthwhile:

Do you know why silver prices in Shanghai seem to always be trading at a premium to London? Because the price quoted out of Shanghai includes a 17% VAT. Without the VAT, silver in Shanghai would be ay a discount to London! Where on earth have you ever heard that before? You see, that’s what makes Koos so invaluable. He does his own independent research and he is beholden to no one so you’re always going to get the straight skinny.

If you want the best information possible, be sure to follow Koos’ work posted at In the meantime, do yourself a favor and listen to this entire podcast. It’s wll worth your time.

TF

CLICK HERE TO LISTEN

This post was published at TF Metals Report on October 11, 2014.

New Zero Bound Only Game In Town

The Federal Reserve tried to fix the U. S. economy by Quantifornication – stimulus measures.

The Federal Reserve tried to fix the U. S. economy by Quantifornication – stimulus measures.

Investors reacted to the Fed’s unconventional efforts. Since the U. S. dollar is the world’s reserve currency and precious metals are priced in dollars they bought gold and silver to protect their wealth against currency devaluation and inflation.

Gold catapulted to a record in 2011 as investors wagered on higher inflation and a weakening dollar.

Gold and silver soar in price

How things have changed, the dollar has recently gained a lot of new friends while gold has very few left. The Fed is going to end its bond-purchasing program this month and start raising interest rates sometime in 2015, experts are talking June/July.

Investors believe:

A substantial upward trend in real interest rates will soon begin. In a strengthening economy. In a future where there is no inflation. Expectations regarding the Fed’s present, and it’s next moves, are pushing the dollar ever higher, gold and silver lower.

The chart above compares the movement in the dollar index with gold’s price.

Have investors got it wrong? Should we be more happy about rising interest rates or more worried about Russia/Ukraine, religious genocide, China and its deteriorating relations with other China Sea stakeholders, Ebola, very weak macroeconomic data coming out of Europe/Japan/Brazil, a slowdown in China and more than a few other hot buttons?

And do rising long rates really threaten gold? Has gold’s price ever gone up in conjunction with rising interest rates?

The following information and snippet is from Adam Hamilton and Scott Wright over at Zeal Intelligence.

Between August 1976 and January 1980 gold went up 731.7 percent, at the same time 10y Treasury yields climbed from 7.7 percent to 11.0 percent, a 42.2 percent climb.

From April 2001 to May 2006 gold nearly tripled with a 180.6 percent gain. During that time the average yield in benchmark 10y Treasuries was over 4.4 percent.

This post was published at Gold-Eagle on October 11, 2014.

PUTIN PLAYING CHESS, OBAMA PLAYING TIDDLY WINKS

I thought our economic sanctions were destroying Russia. We know they have pushed Germany into recession. Does a country on the verge of economic collapse, as our captured MSM blathers about on a daily basis, pay down $53 billion of debt in one quarter? Our empire adds $200 billion of debt per quarter.

I thought our economic sanctions were destroying Russia. We know they have pushed Germany into recession. Does a country on the verge of economic collapse, as our captured MSM blathers about on a daily basis, pay down $53 billion of debt in one quarter? Our empire adds $200 billion of debt per quarter.

Russian debt as a percentage of GDP is 13%. U. S. debt as a percentage of GDP is 101%. Who are we fooling. We live in the out of control empire in decline. Russia already experienced their fall. They learned their lesson. Debt leads to decline. Putin will win this economic battle. Obama’s master plan is to try and bankrupt Russia by driving the price of oil down and making Europe stop trade with Russia. In the short term Russia will be negatively impacted. The Russians are a stoic people. They aren’t spoiled, debt addicted, iGadget distracted morons. They’ll withstand the pain without making a peep. Putin’s popularity is near 80%.

This post was published at The Burning Platform on 11th October 2014.

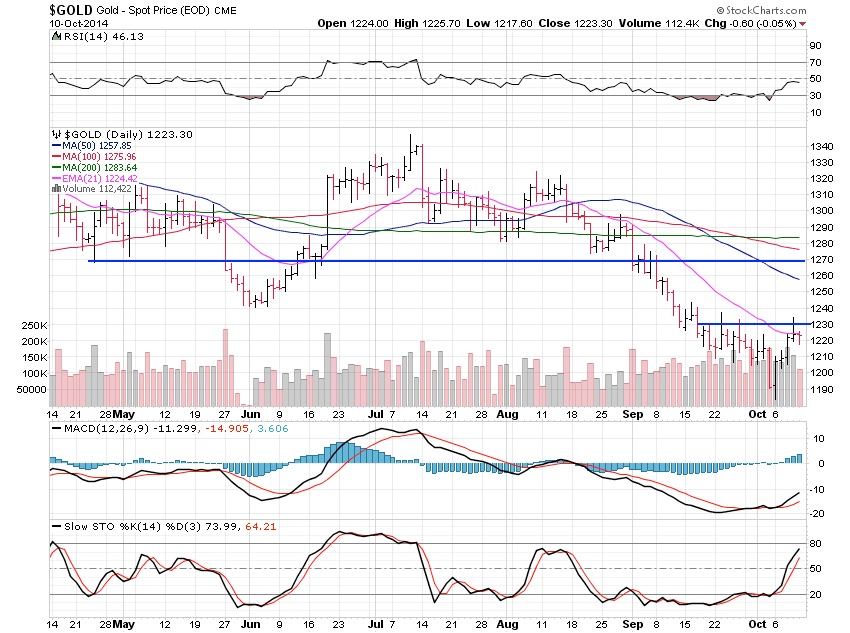

Weekly Gold Trend Analysis: Stocks Sink as Gold Demand Rises

The dollar went down and down and so did stocks. And thus – the story goes – gold is valued more against the dollar than it was last week. Or, as Reuters puts it, “Gold retained gains from a four-day rally on Friday and was headed for its best week in nearly four months.” Safe-haven buying anyone?

The dollar went down and down and so did stocks. And thus – the story goes – gold is valued more against the dollar than it was last week. Or, as Reuters puts it, “Gold retained gains from a four-day rally on Friday and was headed for its best week in nearly four months.” Safe-haven buying anyone?

This Week’s Monetary and Industrial Trends

October is the cruelest month for stocks, which slumped again on Friday, victims of bad sales forecasts in the technology sector and perceived economic problems abroad. There was positive news on Wednesday with the release of Fed notes that indicated policy makers were reluctant to raise interest rates. Stocks jumped, but then promptly fell again on Thursday.

Friday was choppier, with the Dow trending sideways before finding a significant downward direction. AP summarized the damage: “The Dow Jones industrial average lost 115 points, or 0.7 percent, to 16,544 Friday. The Standard and Poor’s 500 fell 22 points, or 1.2 percent, to 1,906. The technology-heavy Nasdaq fell 102 points, or 2.3 percent, to 4,276.

” It was a wild week for markets with sharp swings – down, up and down. In fact, Wednesday marked the Dow’s biggest rise while Thursday generated its biggest decline. Bond prices rose, always a sign of equity nervousness.

Impact on Gold

Gold benefited stock troubles this past week, as Reuters tells us:

Spot gold was steady at $1,223.20 an ounce by 0641 GMT, after hitting a 2-1/2 week high of $1,233.20 in the previous session. The metal has risen more than 2.7 percent for the week, its best since the week ended June 20, after recovering from a 15-month-low under $1,200 hit on Monday.

This post was published at The Daily Bell on October 11, 2014.

Targets Hit…And Bounce Trade Is Over Already

A wild week as markets began to act very sloppy. Wide and loose action with large daily swings is rarely a good thing and we are now beginning to break lower.

A wild week as markets began to act very sloppy. Wide and loose action with large daily swings is rarely a good thing and we are now beginning to break lower.

I’m still not sure just how deep this correction will go…but 200-day moving averages are coming into sight now, and should provide support or the ultimate low.

As for stocks, we were lucky enough to have nailed one who rose some 60% in a couple days but that was a rare sight last week.

I’m short a couple names right now and only using small position sizes if I take a trade at all.

The metals finally began to stabilize…but I’m still not so sure a low is in. After such a large and constant fall, metals need a rest. It is that simple. They can rest a couple months and rise and fall all the while. A major low could be in but I’m not yet convinced of that yet.

If a low is in place, we will have lots of time and tons of chances to get in. There is no rush to try to catch the exact low.

Gold gained 2.70% for the week. Thursday saw a nice move right up to $1,230 resistance before it backed off. Unfortunately the move happened in overseas trading before our North American markets opened as so often happens, leaving us out. I’m in no rush or panic to buy gold here yet although the emails are starting to come back in from the regulars telling me gold has bottomed and is going higher and what not. Time will tell.

This post was published at Gold-Eagle on October 11, 2014.

What’s RIGHT With the Euro

You read that right. Right.

You read that right. Right.

I think like an economist. The economist always thinks in terms of alternatives. The economist’s mindset was expressed clearly by the late comedian, Henny Youngman. “How’s your wife?” “Compared to what?”

One of the most common complaints against the eurozone is this one: “The eurozone is a central currency, but decentralized national fiscal policies.” I have never seen one of the critics who invoke this argument propose the abolition of the euro and the European Central Bank. This argument is always offered to defend the idea of fiscal union. In other words, there is no push to decentralize the currencies of the eurozone. There is a strong, but so far ineffective, push to unify the fiscal policies of the eurozone.

Think through the implications of this. Can you see what is wrong with this argument?

A KEYNESIAN ARGUMENT

This argument is inherently Keynesian. It relies on the fallacious idea that national government deficits overcome recessions. A related idea is that government deficits promote economic growth. But all good Keynesians know that national government deficits require monetary inflation in order to sustain them, because without monetary inflation, interest rates will rise in response to the increased deficits. So, the Keynesian argues, because it is necessary that various countries have different degrees of deficit, depending on the business cycle in a particular country, the imposition of a single currency on top of multiple national economic cycles cannot be sustained.

This is all part of the worldview which began no later than the Versailles conference after World War I, in 1919. We have seen one sustained attempt to create a single European state. This single European state is supposed to have a single currency, a single central bank, and a single fiscal policy.

Let us go back to 1914. From the end of the Napoleonic wars in 1815 until the outbreak of World War I in mid-1914, the Western world enjoyed the benefits of an international gold coin standard. There was no centralized monetary policy. There was a single currency that was used in international trade, and in most of the countries involved, there was a domestic gold coin standard. Citizens could go to a bank and demand payment in gold coins in exchange for a domestic currency. This acted as a brake on the expansion of domestic currencies.

This post was published at Gary North on October 11, 2014.

The Four Questions Goldman’s “Confused, Understandably Frustrated” Clients Are Asking

One would think that after last week’s market rout, the worst in years, that Goldman clients would have just one question: why just a month after you, chief Goldman strategist David Kostin said to “Buy Stocks Because Hedge Funds Suck; Also Chase Momentum And Beta“, are stocks crashing? No really: this is literally what Kostin said in the first days of September: “investors should buy stocks which should benefit from a combination of beta, momentum, and popularity as funds attempt to remedy their weak YTD performance heading into late 2014.” Turns out frontrunning the world’s most overpaid money losers wasn’t such a great strategy after all. In any event, that is not what Goldman’s clients are asking. Instead as David Kostin informs us in his weekly letter to Jim Hanson’s beloved creations, “every client inquiry focused on the same four topics: global growth, FX, oil, and small-caps.”

One would think that after last week’s market rout, the worst in years, that Goldman clients would have just one question: why just a month after you, chief Goldman strategist David Kostin said to “Buy Stocks Because Hedge Funds Suck; Also Chase Momentum And Beta“, are stocks crashing? No really: this is literally what Kostin said in the first days of September: “investors should buy stocks which should benefit from a combination of beta, momentum, and popularity as funds attempt to remedy their weak YTD performance heading into late 2014.” Turns out frontrunning the world’s most overpaid money losers wasn’t such a great strategy after all. In any event, that is not what Goldman’s clients are asking. Instead as David Kostin informs us in his weekly letter to Jim Hanson’s beloved creations, “every client inquiry focused on the same four topics: global growth, FX, oil, and small-caps.”

So while said clients figure out just what the right question is, here are the wrong ones, aka Goldman’s damage control:

Policymakers focus on anemic growth in Europe and Japan while US economic and company fundamentals remain strong. Investors should focus on ‘American exceptionalism’ and own stocks with high domestic sales. We forecast S&P 500 will rebound by 7% to reach our year-end target of 2050. Buybacks have been the major source of demand for US equities during the past four years with S&P 500 firms repurchasing more than $1.5 trillion of shares. Peak 3Q reporting season is the next three weeks. Halloween will be the end of the blackout period for most firms. In recent years, 25% of annual buybacks have occurred in November and December. Conversations we are having with clients: Confusion over growth, FX, oil, and small-caps

“Whiplash’ is how one veteran investor described this week’s market. S&P 500 fell 1.5% on Tuesday as the IMF’s newest World Economic Outlook discussed the weak prospects for global growth. Wednesday registered 2014’s best daily return ( 1.8%) supported by the release of Fed minutes that noted US growth ‘might be slower than they expected if foreign economic growth came in weaker than anticipated’. The clear implication: Interest rates might be held lower for longer than market participants expected. This comfort was short-lived – S&P 500 sank 2% on Thursday and 1% on Friday.

Four topics dominated client discussions this week: (1) The uneven global economic outlook with the US expanding above-trend, China slowing, and Europe barely growing; (2) US dollar strength and a euro rapidly moving towards parity by 2017; (3) the bear market in crude oil with Brent plunging by more than 20% since June; and (4) the dismal returns for US small-cap stocks with the Russell 2000 index lagging by 13% YTD for the largest underperformance vs. the S&P 500 since the Tech bubble in 2000.

This post was published at Zero Hedge on 10/11/2014.

Weekday Wrap-Up: Bitcoins and Goldbugs, Q3 Earnings Signals, $40 Oil, and Geopolitical Feedback Loops

Dominic Frisby says Satoshi Nakamoto is a goldbug and explains how bitcoin was designed to replicate gold mining. Sheraz Mian of Zacks Investment Research says third quarter earnings season will be very important this year and explains why. Jeff Rubin, who used to think we’d see $200 oil prices, is now calling for oil to hit $40-50 a barrel; and, the last guest to our show this week, Don Coxe, explains the difficulty of anticipating geopolitical feedback loops on the financial markets.

Dominic Frisby says Satoshi Nakamoto is a goldbug and explains how bitcoin was designed to replicate gold mining. Sheraz Mian of Zacks Investment Research says third quarter earnings season will be very important this year and explains why. Jeff Rubin, who used to think we’d see $200 oil prices, is now calling for oil to hit $40-50 a barrel; and, the last guest to our show this week, Don Coxe, explains the difficulty of anticipating geopolitical feedback loops on the financial markets.

Here are a few excerpts from this week’s set of interviews, which recently aired to our subscribers in full (click here for more info).

Here’s Dominic Frisby on how Satoshi was a goldbug and created bitcoin to replicate gold mining:

“The guy who invented Bitcoin, Satoshi Nakamoto…if I’m right in who he is, he was a great great student of money. He wrote loads of papers about money and he was a goldbug. He hated inflation; he hated what governments were doing to money – the manipulation of interest rates – and in some of his other work he described inflation as pernicious; and his aim was to as closely as possible replicate the effects of gold digitally. So he wanted a sound money. He wanted a deflationary system of money. He wanted a money where there’s limited supply. The whole process of creating bitcoins on your computer known as mining was designed totally to replicate the gold mining process…” (Click here for audio)

This post was published at FinancialSense on 10/10/2014.

Oath Keepers CPT Journal – Eureka, Montana, October 8th, 2014

This article was written by Brandon Smith and originally published at Oath Keepers

This article was written by Brandon Smith and originally published at Oath Keepers

The Oath Keepers CPT (Community Preparedness Teams) program is the BEST existing solution offered to the Liberty Movement today in the wake of numerous national and international crises. I have not yet seen a single other program or effort that comes close in value to the general American public. It combines all of the necessary knowledge, skills, and organization required for a community of people, no matter where they happen to live, to be able to survive and thrive a large scale disaster scenario, and to provide the ability to rebuild and help others once the smoke has cleared.

It should be obvious to most people by now, especially Constitutional activists, that America is already in the path of a great landslide of economic, social, and political instability. This landslide cannot be stopped. It cannot be turned back. There are no silver bullet solutions, and there never will be. Given this fact, we can continue to plead in futility for the corrupt establishment to police itself, curl up in a ball and be buried by the chaos, or, we can rise above it through dedicated preparation and organization.

The goal of CPT is to make every neighborhood, county, and state in the country as independent, secure, and self sufficient as possible, erasing the fear of the common citizen, which ultimately thwarts the rise of tyranny within our society. A people without fear cannot be ruled.

This post was published at Alt-Market on 11 October 2014.

Economic News Update: De-Dollarization accelerates / London sellingYuan bonds

The following video was published by Paul Sandhu on Oct 11, 2014

Stock Market or Thrill Ride?

Here’s the action of the Dow Jones Industrial Average on Tuesday, Wednesday and Thursday of this week: down 273 points; up 274.8 points; down 334.97 points. In the span of a week the stock market has taken investors on a stomach-churning roller-coaster ride and futures are pointing to a weak open this morning.

Here’s the action of the Dow Jones Industrial Average on Tuesday, Wednesday and Thursday of this week: down 273 points; up 274.8 points; down 334.97 points. In the span of a week the stock market has taken investors on a stomach-churning roller-coaster ride and futures are pointing to a weak open this morning.

What’s rattling the market? Headlines have incorrectly simplified the worry to concerns on global growth. But that inadequately explains the underlying fears that are causing the gyrations and sending the timid to the exits. Wall Street On Parade will have an in-depth analysis of the core issues this coming Monday.

This post was published at Wall Street On Parade on October 10, 2014.

IS OBAMA “THE BEST ECONOMIC PRESIDENT IN MODERN TIMES?”

This week, people still brainwashed by the two-party system have shared articles with titles like “It’s Official: President Obama Is The Best Economic President In Modern Times.” Taking the clickbait, I dove head first into this article, only to discover it was linking to Forbes, a publication that I think, from time to time, has a few generally good articles on the economy. But this one is so ridiculous I had to double check if it was from The Onion.

This week, people still brainwashed by the two-party system have shared articles with titles like “It’s Official: President Obama Is The Best Economic President In Modern Times.” Taking the clickbait, I dove head first into this article, only to discover it was linking to Forbes, a publication that I think, from time to time, has a few generally good articles on the economy. But this one is so ridiculous I had to double check if it was from The Onion.

The article is flawed, to say the least. For instance, that “since May 2013 the stock market has consistently been hitting highs” is no reason to cite for the economy being strong. There’s no mention that highs in the stock market are results of the Federal Reserve printing money with wild abandon.

The Forbes writer is the equivalent of showering praise on Robert Mugabe and his central bankster cohort, Gideon Gono, for how well the Zimbabwe stock market was doing in June of 2008. Soon the central bank there would be printing trillion dollar notes.

Imagine how much they would have loved Mugabe by July when the stock market had skyrocketed to 6 trillion! It kept going higher too. By October 22, 2008, the stock market was up 3,500% in one day alone! Emmanuel Munyukwi, chief executive of the Zimbabwe Stock Exchange, said on that day, “Some people think that this is a bubble about to burst but I don’t think so.”

If Munyukwi isn’t now working as an economic reporter at Forbes he should be!

Another reason cited for Obama’s best President status is his job’s record.

When The Bureau of Labor Statistics (BLS or more appropriately, simply, BS) issued its most recent jobs report, it disappointed many people who were expecting another month above 200,000 jobs added to the economy. People were optimistic. Those greenshoots were now a valley full of diversity and bounty or so they thought. But others, like Bob Deitrick, CEO of Polaris Financial Partners, remained impressed by Obama’s job record, as he told Forbes.

This post was published at Dollar Vigilante on 2014/10/10.

Gold And Silver – An End Still Not In Sight

Miscellaneous, with a central not-so-apparent binder. Do they relate to gold and silver? In a way, yes.

Miscellaneous, with a central not-so-apparent binder. Do they relate to gold and silver? In a way, yes.

At the end of September, Yahoo ran a picture of Putin along side of Stalin. No too much in the way of suggestive association at play here by the media intent on pleasing the elites and federal government. The caption was what the two have in common, both from Russia certainly being one. What we know for sure is that neither ever won a Nobel Peace Prize, and neither has been responsible for inciting wars all across the globe and bombing other countries into submission, so Obomba is one-up on them in that regard, but his photo did not appear in the line up.

Question? How many countries have Russian troops on their soil? The US has maybe over 150. How many drone strikes has Russia conducted against other sovereign nations? No one has unleashed more killer drone strikes than Barack Hussein Obomba. No one. How many Islamic extremist groups has Russia trained and armed? The CIA has created, armed and trained al-Quida, and now ISIS with the intent is to create chaos in the Middle East as an indirect deflection for bringing down Assad in Syria and attempting to disrupt the flow of Russian oil and natural gas to Europe, trying to save the fast-sinking US fiat petrodollar.

~

Few Americans have ever heard of Udo Ulfkotte, a former editor of Frankfurter Allgemeine Zeitung [one of Germany’s largest newspapers]. The CIA had been pimping him out to write pro-American articles for German and international consumption. He had an ‘aha’ moment of conscientiousness when he could see how the US has been pushing so hard for war, and he had had his fill of lying for the US government. There is an article and clip from RT News, but do not be put off by the news source. No US media would ever give it coverage. It is interesting, especially for Americans who do not get any or much news outside of elite-controlled mainstream news.

Lest anyone think the story lacks credibility, we did an article a few weeks ago of a US journalist who refused to cooperate and, in fact, wrote an expose on the CIA employing journalists in this country, [Do You Trust The Government, Or The Media?]. The movie, Dark Alliance, is due out soon.

This post was published at Edge Trader Plus on 11 October 2014.

Fear?

So much for stock market complacency.. the VIX – Volatility Index – or as I prefer to call it, the Complacency Index, hit a 10 month high today. The bulls have pretty much had a one way market for as long as we can seemingly remember. Looks like that has changed some! We have gone from confidence to uncertainty to concern. We have not reached fear however.

So much for stock market complacency.. the VIX – Volatility Index – or as I prefer to call it, the Complacency Index, hit a 10 month high today. The bulls have pretty much had a one way market for as long as we can seemingly remember. Looks like that has changed some! We have gone from confidence to uncertainty to concern. We have not reached fear however.

By the way, further confirmation that those who have been preaching hyperinflation and currency induced cost push and whatever for so many years have been utterly confounded. The yield on the Ten Year Treasury hit a 16 MONTH LOW today!

This post was published at Trader Dan Norcini on October 10, 2014.

Just the start of a correction for US stocks no sign of capitulation

How low do US stocks go after the worst week in two years for the market? This is not to be mixed up with normal market volatility there is a far deeper correction in progress now with absolutely no sign of the capitulation phase that would mark its end like we saw in gold prices last week. Gold was up sharply as stocks slumped.

How low do US stocks go after the worst week in two years for the market? This is not to be mixed up with normal market volatility there is a far deeper correction in progress now with absolutely no sign of the capitulation phase that would mark its end like we saw in gold prices last week. Gold was up sharply as stocks slumped.

Insight to the correlation between monetary policy and investor behavior, with Charles Biderman, TrimTabs Investment Research…

CLICK HERE TO WATCH VIDEO

This post was published at Arabian Money on 11 October 2014.

PM Fund Manager Explains How Bullion Banks Can Continue PM Manipulation

The following video was published by SilverDoctors on Oct 10, 2014

PM Fund Manager Dave Kranzler joins us this week for a power packed show discussing:

1. Triple Bottom or Dead Cat Bounce? The outlook for gold & silver over the next 6 months 2. Physical silver update- demand explodes as more physical sold in the first week of October than all of July & August! 3. Giant House of Cards- why the fundamental economy has been completely rotted out 4. Kranzler explains that the banks have been able to continue manipulating silver futures far longer than expected because only 2% of futures contracts ever stand for delivery 5. No other commodities market in which the amount of outstanding futures contracts to the underlying deliverable is so out of balance- this would all end if the longs would simply STAND FOR PHYSICAL DELIVERY

Harvey Organ’s Gold and Silver Blog Taken Down Exactly One Month After Predicting 2014 End Game For Silver Suppression

Several patrons have asked me if I know what has happened to Harvey Organ’s popular precious metals blog.

Several patrons have asked me if I know what has happened to Harvey Organ’s popular precious metals blog.

I have been given to understand that his site on Google blogger has been ‘deleted by court order’ and in accordance with Google’s terms of service and content policy.

The specific terms of the court order or the originator have not been revealed to me.

I had thought Harvey’s blog was fairly benign, and Google has been fairly easy to work with based on my own experience.

Things like this generally involve either alleged copyright infringement or some sort of defamation. Harvey was based in Canada, and I do not know if Canadian laws on this are different than US laws, or even which jurisdiction issued the court order. I do not care to speculate. This is all that I know. If I find out more, which I hope will be the case, I will pass that along.

You may find some ‘back issues’ of Harvey’s blog on the Internet Archive here.

We’ll always have Paris. Here’s looking at you, kid.

This post was published at Jesses Crossroads Cafe on 10 OCTOBER 2014.

5 Reasons Why The Gold Price Could Have Bottomed at $1,180

The yellow metal has fallen nearly 40% from its 2011 high above 1900 to trade below 1200 at the start of this week, mirroring Columbus’s own fall from grace as more of his transgressions have been brought to light. We want to highlight five reasons that gold may not be irreparably damaged:

The yellow metal has fallen nearly 40% from its 2011 high above 1900 to trade below 1200 at the start of this week, mirroring Columbus’s own fall from grace as more of his transgressions have been brought to light. We want to highlight five reasons that gold may not be irreparably damaged:

1) Strong Previous Support at 1180

The first and most obvious reason that gold may bounce from here is that it tested strong previous support at 1180 earlier this week. This support level put a floor under the metal’s price in both June and December of 2013, leading to a 200 point rally in each case. While gold has been putting in a series of lower highs over the last few years, a bounce back toward at least 1300 is possible off this key floor.

2) Bullish Gartley Pattern Projects a Rally off 1180

In addition to representing a key level of previous support, the 1180 level also marks the completion of a multi-month Bullish Gartley ‘222’ pattern. For the uninitiated, this formation is named after the author (H. M. Gartley) and page number (222) of the first book to describe it (Profits in the Stock Market) way back in 1935. In essence, it helps traders identify higher-probability turning points in the market from the confluence of multiple Fibonacci levels.

In this case, the 100% retracement of XA, 161.8% Fibonacci extension of BC, and ABCD pattern (where the AB leg is the same length as the BC leg) all converge at 1180 (see chart below). When multiple different support levels converge, the probability of a rally from that floor is increased.

This post was published at GoldSilverWorlds on October 10, 2014.

The Fed’s 2% Inflation Target: The Ultimate Keynesian Con Job

The old adage that if something is repeated often enough it is soon assumed to be true couldn’t be more apt with respect to the Fed’s 2% inflation target. Today Bloomberg has a piece that does exactly that, describing how’Federal Reserve officials are hunting for new tactics to raise price increases to their target’ because ‘inflation is descending toward the danger zone’.

The old adage that if something is repeated often enough it is soon assumed to be true couldn’t be more apt with respect to the Fed’s 2% inflation target. Today Bloomberg has a piece that does exactly that, describing how’Federal Reserve officials are hunting for new tactics to raise price increases to their target’ because ‘inflation is descending toward the danger zone’.

In fact, the September meeting notes cited several officials who worried that ‘inflation might persist below’ the committees target for ‘quite some time.’ Accordingly, the Bloomberg author, Craig Torres, pulled out his editorial pen and offered his opinion as if it were objectively obvious:

The Fed needs a clear strategy for getting the inflation rate higher after falling short of its 2 percent target for 28 consecutive months.

Well, now. Twenty-eight straight months of misses. Let’s see, even using the Fed’s systematically understated measure of inflation, the PCE deflator ex-food and energy, consumers’ savings and paychecks have lost 3.3% of their purchasing power during the last 28 months.

Apparently, had they instead suffered a 4.7% loss of purchasing power (2% inflation for 2.33 years) everything would be copasetic. Instead of remaining in a funk, as has been evident since it unexpectedly snowed last winter, they would have been spending up a storm. Presumably the US economy would have long ago hurtled through that pesky ‘escape velocity’ barrier.

Isn’t it amazing that over the relatively brief period in question that shrinking the purchasing power of the dollar by 4.7%% versus 3.3% could make such a profound difference. Or maybe not.

But don’t expect the ‘journalists’ at Bloomberg to even ask. Like their ‘competitors’ at the WSJ and Reuters, they are about as mainstream, lazy and intellectually sloppy as they come. In this case, it is not likely that a writer who cites two ex-central bank true believers as his main source – -former Fed governor and macro-model peddler, Larry Myers, and former Bank of England policy committee member and current Keynesian snake oil salesman, Adam Posner – -would trouble himself with proof that a 2% annual gain on the CPI is a proven economic elixir.

No, the 2% inflation mantra has been repeated so early and often by Fed speakers, their court economists and the Wall Street stock peddlers known as ‘strategists’ that it appears to amount to the monetary equivalent of the Pythagorean theorem. Even then, the literalist presentation of the matter in the attached story sets a new standard for credulity.

This post was published at David Stockmans Contra Corner on October 10, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments