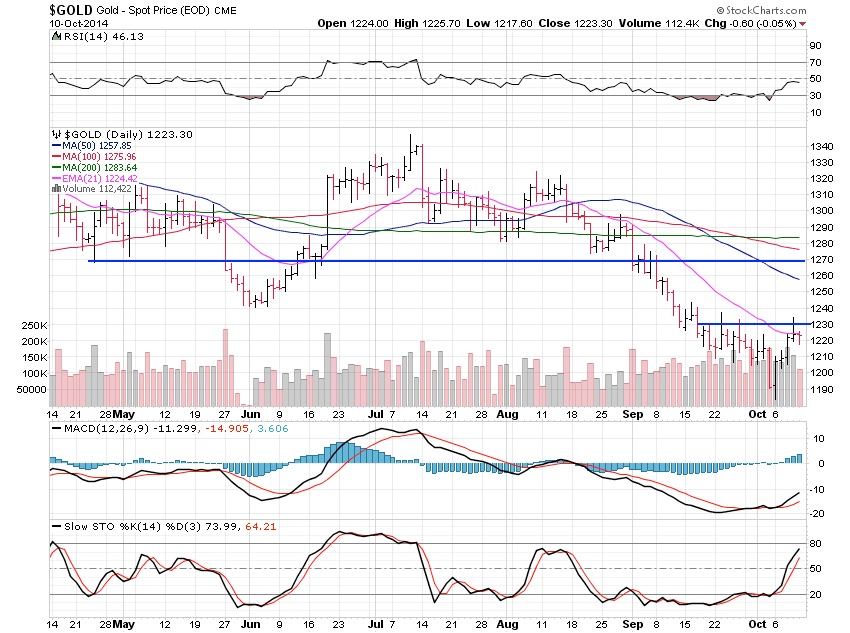

n his weekly market review, Frank Holmes of the USFunds.com summarizes this week’s strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,223.09, up $31.74 per ounce ( 2.66%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 0.24%. The U. S. Trade-Weighted Dollar Index fell 0.90% for the week.

n his weekly market review, Frank Holmes of the USFunds.com summarizes this week’s strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,223.09, up $31.74 per ounce ( 2.66%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 0.24%. The U. S. Trade-Weighted Dollar Index fell 0.90% for the week.

Gold Market Strengths Gold futures rose this week as many anticipate the Chinese will take advantage of lower gold prices. Indeed, gold seemed to withstand recent decreases in oil prices as well as increases in the dollar, implying that many investors are taking advantage of the bargain prices. On Friday, the Bank Credit Analyst highlighted that gold prices are unlikely to break down after successfully bouncing off support at $1,200 and are poised to stage a relief rally into the end of the year.

Gold Market Weaknesses Deutsche Bank recommended shorting gold due to the strong dollar environment.

A continuation of the prevailing socialist model in South America, Chile’s Supreme Court granted a petition by the Diaguita communities to overturn a resolution to develop the El Morro gold-copper project joint venture (JV) in Chile. This is the third time Goldcorp’s El Morro project has been suspended in three years.

This post was published at GoldSilverWorlds on October 11, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments