A wild week as markets began to act very sloppy. Wide and loose action with large daily swings is rarely a good thing and we are now beginning to break lower.

A wild week as markets began to act very sloppy. Wide and loose action with large daily swings is rarely a good thing and we are now beginning to break lower.

I’m still not sure just how deep this correction will go…but 200-day moving averages are coming into sight now, and should provide support or the ultimate low.

As for stocks, we were lucky enough to have nailed one who rose some 60% in a couple days but that was a rare sight last week.

I’m short a couple names right now and only using small position sizes if I take a trade at all.

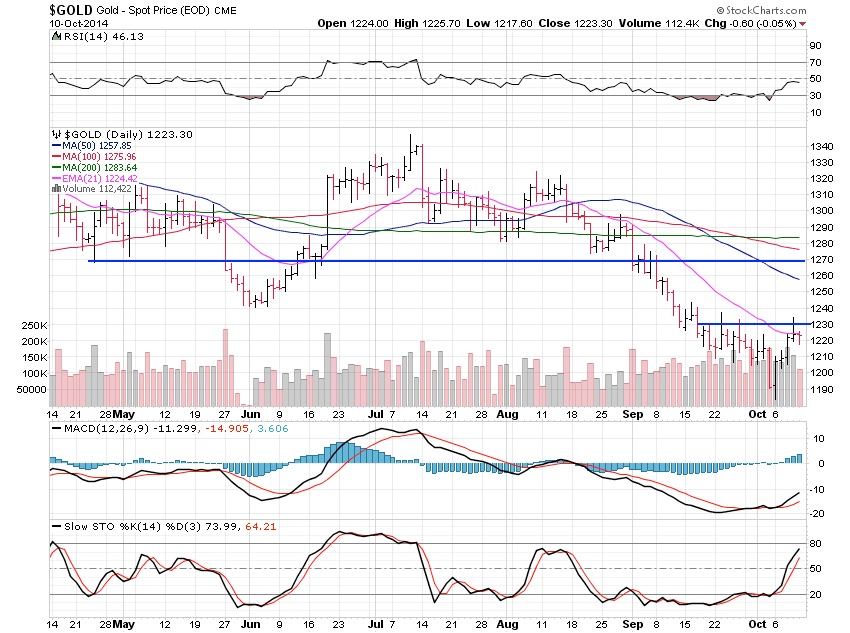

The metals finally began to stabilize…but I’m still not so sure a low is in. After such a large and constant fall, metals need a rest. It is that simple. They can rest a couple months and rise and fall all the while. A major low could be in but I’m not yet convinced of that yet.

If a low is in place, we will have lots of time and tons of chances to get in. There is no rush to try to catch the exact low.

Gold gained 2.70% for the week. Thursday saw a nice move right up to $1,230 resistance before it backed off. Unfortunately the move happened in overseas trading before our North American markets opened as so often happens, leaving us out. I’m in no rush or panic to buy gold here yet although the emails are starting to come back in from the regulars telling me gold has bottomed and is going higher and what not. Time will tell.

This post was published at Gold-Eagle on October 11, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments