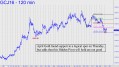

Gold has been adrift for six weeks, a time period that corresponds almost exactly to the stock market’s bear rally from mid-February’s lows. I view the rally as doomed, implying that we will see gold resume its upward course when stocks yield to gravity, as they eventually must. The precise timing of this is unknowable, but with the broad averages hovering within a few percentage points of presumably unattainable new-record highs, we may not have long to wait. More immediately, the April contract will have an opportunity to hold the line with some pushback from a Hidden Pivot support at 1210.10 that contained sellers on Thursday. The bounce so far has not been very robust and would need to go a further $20, exceeding 1237.00, to give bulls some breathing room. This looked like a dubious bet as the week ended, however, since stock-market bears had trapped themselves in a vicious short-squeeze just ahead of the three-day weekend. Assuming bullion eases lower, look for a test of the 1191.50 bottom whence the April contract embarked on a modest three-week rally of about $100. The gains have all but vanished in the last two weeks, but the larger, bullish picture going back to late December’s lows remains very much intact.

Gold has been adrift for six weeks, a time period that corresponds almost exactly to the stock market’s bear rally from mid-February’s lows. I view the rally as doomed, implying that we will see gold resume its upward course when stocks yield to gravity, as they eventually must. The precise timing of this is unknowable, but with the broad averages hovering within a few percentage points of presumably unattainable new-record highs, we may not have long to wait. More immediately, the April contract will have an opportunity to hold the line with some pushback from a Hidden Pivot support at 1210.10 that contained sellers on Thursday. The bounce so far has not been very robust and would need to go a further $20, exceeding 1237.00, to give bulls some breathing room. This looked like a dubious bet as the week ended, however, since stock-market bears had trapped themselves in a vicious short-squeeze just ahead of the three-day weekend. Assuming bullion eases lower, look for a test of the 1191.50 bottom whence the April contract embarked on a modest three-week rally of about $100. The gains have all but vanished in the last two weeks, but the larger, bullish picture going back to late December’s lows remains very much intact.

RICK’S PICKS

This post was published at Rick Ackerman on March 27, 2016,.

Follow on Twitter

Follow on Twitter

Recent Comments