Last year, I was roundly criticized when I said the Cyprus scenario is coming here. I was told there would be a revolution if this happened and the government would be to afraid to try such a thing. I marvel at people who hold to such naive beliefs. The American people have been through several beta tests related to our private wealth being confiscated and no resistance was offered (e.g. MF Global).

Last year, I was roundly criticized when I said the Cyprus scenario is coming here. I was told there would be a revolution if this happened and the government would be to afraid to try such a thing. I marvel at people who hold to such naive beliefs. The American people have been through several beta tests related to our private wealth being confiscated and no resistance was offered (e.g. MF Global).

Listening to the sheep that believe Wolf Blitzer who tells us that the economy is in recovery, is like listening to a country song played backwards. You know the all-to-familiar message, the wife does not leave, the truck still runs and the guy stops drinking. Maybe it is all the fluoride in the water that is causing such widespread ignorance and apathy.

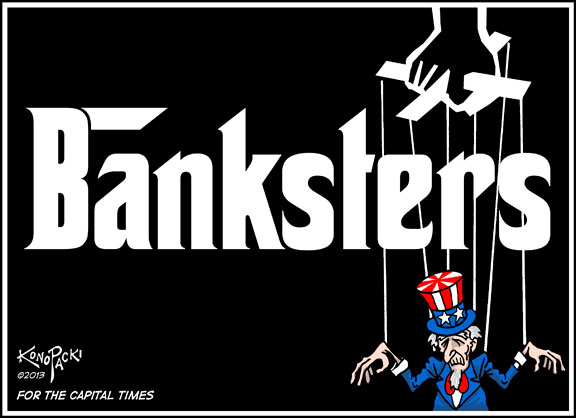

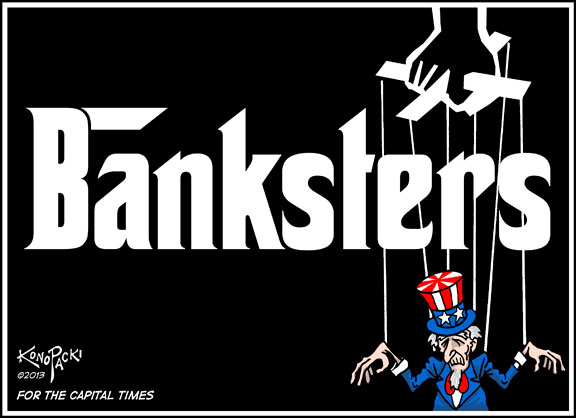

First of all, our government is not the main enemy. This is not the government we are dealing with. We are battling organized crime in the form of corporations like Goldman Sachs who have hijacked our government and now they have captured the G20. They are lining up for the last great garage sale before they collapse the economy and roll out martial law. There are forces lining up to steal everything that you and I own. It has already begun but this country is so dumbed down, we do not see that it has already started.

The Bankers Have Committed a Coup Against the United States Government

The United States government is not your main enemy, it is the banksters who have hijacked your government. Some of the sheep might be wondering when that happened. The year was 2008 and the event was called a bail-out. This evil was born in 1913 with the creation of the Federal Reserve. This pervasive evil killed America when the first dollar arrived at the door of Goldman Sachs in the form of a bail-out in 2008. Bye-Bye Miss American Pie, that was the day the music died for America.

Yesterday, on November 16, 2014, it was revealed that when you awakened, a new G20 policy was enacted which effectively stole your bank account. For the time being, you still have some access to some of your money. If you have $100,000 in the bank, try taking that money out today and see how fast the Federal authorities show up in your life. And if you did manage to get your money out of the bank, don’t forget about the cop on the corner poised to steal your money under the banner of ‘civilian asset forfeiture’. Pardon me, I digress.

Yesterday’s article revealed that your money, that is in your bank account, is no longer called money. As a result, when the banks begin to fail, one by one, you will not be at the head of the line to collect your reimbursement from the FDIC, you will be last in line because you have no ‘money’ in the bank. This effectively means that you will get nothing for your lost and subsequently confiscated bank account. However, your bank account will not be the only casualty from your financial portfolio. The banksters are preparing to steal EVERYTHING that is not nailed down and thisGRAND THEFT AMERICA will begin with your bank account and will quickly take every other financial asset.

Undoubtedly, the trigger for this approaching calamity will be a series of major bank failures. Some of the sheep will say, ‘there will be no bank failures, will there’?

This post was published at The Common Sense Show on Nov 17, 2014.

Koichi Hamada is a special adviser to prime minister Shinzo Abe and one of his closest confidants. That makes his comments, as The Telegraph reports, even more stunningly concerning. Focusing his attention on the fact that Japan must delay the 2nd stage of its planned consumption tax hike – for fear of derailing the ‘recovery’ – Hamada unwittingly, it seems, explains the terrible reality behind the so-called “godfather” of Abenomics’ perspective on the extreme monetary policy he has unleashed…

Koichi Hamada is a special adviser to prime minister Shinzo Abe and one of his closest confidants. That makes his comments, as The Telegraph reports, even more stunningly concerning. Focusing his attention on the fact that Japan must delay the 2nd stage of its planned consumption tax hike – for fear of derailing the ‘recovery’ – Hamada unwittingly, it seems, explains the terrible reality behind the so-called “godfather” of Abenomics’ perspective on the extreme monetary policy he has unleashed…

Follow on Twitter

Follow on Twitter

Recent Comments