Bankers and investors around the world have started to express concern about the rapidly inflating stock market bubble, and its future impact on the world economy. You can add Tiger Management co-founder Julian Robertson to that list.

Bankers and investors around the world have started to express concern about the rapidly inflating stock market bubble, and its future impact on the world economy. You can add Tiger Management co-founder Julian Robertson to that list.

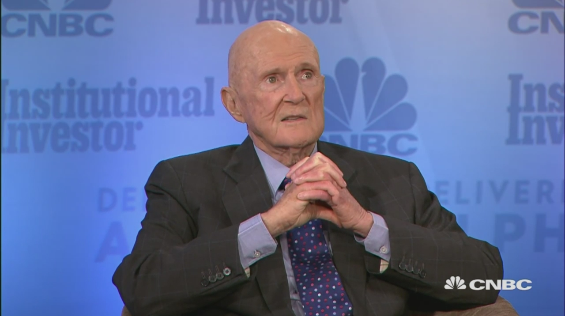

Robertson appeared on CNBC with Kelly Evans and unequivocally called the stock market a bubble. Not only that, he said it was the Federal Reserve’s fault.

Robertson said he thinks low interested rates have inflated stock market valuations. There simply isn’t anyplace else for money to flow.

Well, we’re very, very high – have very high valuations in most stocks. The market, as a whole, is quite high on a historic basis. And I think that’s due to the fact that interest rates are so low that there’s no real competition for the money other than art and real estate. And so I think that’s why the valuations are so high. I think when rates do start to go up and the bonds become more attractive to investors, it will affect the margins.’

This post was published at Schiffgold on SEPTEMBER 13, 2017.

Follow on Twitter

Follow on Twitter

Recent Comments