Being a landlord is no easy task. In the long run owning a rental property can be a nice addition to your investment portfolio but there is nothing sexy about it. Many small time landlords only start to see the benefits many years into holding the property. For the most part, this is why Wall Street and large hedge funds have avoided owning single family homes in their portfolios. That of course changed in 2007 when the market went into full on implosion mode and the mantra of the day was ‘chase yield anywhere you can find it.’ There is this odd notion that somehow all the great deals went to other families that timed the market perfectly. The excellent deals of 2008 to 2011 were happening at a time when the economy was in crisis mode. Some of the best deals to be had were done via auctions and you needed to have a cashier’s check to play so many regular people had no access to this. 7 million foreclosures and many of these are now in the hands of investors. The homeownership rate is a clear indication of this. It should also be no surprise that we’ve added 7 million renting households. How big of a change have we seen? Rental income which held steady between 2000 and 2007 at roughly $200 billion per year is now up 240 percent coming in at $640 billion. Since few people actually own rentals, this is money flowing into a concentrated group.

Being a landlord is no easy task. In the long run owning a rental property can be a nice addition to your investment portfolio but there is nothing sexy about it. Many small time landlords only start to see the benefits many years into holding the property. For the most part, this is why Wall Street and large hedge funds have avoided owning single family homes in their portfolios. That of course changed in 2007 when the market went into full on implosion mode and the mantra of the day was ‘chase yield anywhere you can find it.’ There is this odd notion that somehow all the great deals went to other families that timed the market perfectly. The excellent deals of 2008 to 2011 were happening at a time when the economy was in crisis mode. Some of the best deals to be had were done via auctions and you needed to have a cashier’s check to play so many regular people had no access to this. 7 million foreclosures and many of these are now in the hands of investors. The homeownership rate is a clear indication of this. It should also be no surprise that we’ve added 7 million renting households. How big of a change have we seen? Rental income which held steady between 2000 and 2007 at roughly $200 billion per year is now up 240 percent coming in at $640 billion. Since few people actually own rentals, this is money flowing into a concentrated group.

Send those rent checks in

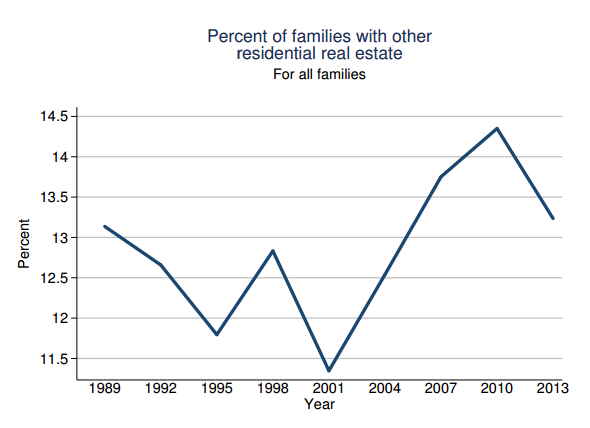

How many people in the US actually own rental property? The figures are hard to get but the number is very low. The Fed does an extensive survey on consumer finances and found that in 2013, roughly 13 percent of families had another property outside of their primary residence compared to nearly 50 percent that have some money in retirement funds. Keep in mind however, that this number includes vacation homes so these are not all rentals.

First let us look at the number of households with other real estate besides their own property:

This post was published at Doctor Housing Bubble on December 4th, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments