Eighteen years ago, G. Edward Griffin wrote The Creature from Jekyll Island and exposed the Federal Reserve’s true nature. Since that initial writing, the knowledge of the fact that the Fed is not a government institution, but a privately owned central banking cartel has expanded in public awareness. In this remarkably lucid interview with Casey Research’s Louis James, Griffin discusses:

- The growing size of government

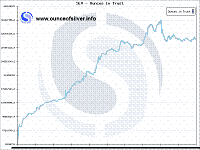

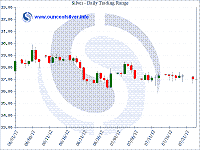

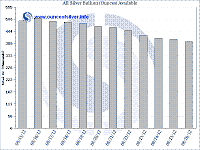

- The decline of the purchasing power of the US dollar

- The two-party political system is really a cover for a one-party system

- The realistic expectations of public awakening prior to a collapse

- The Fed is a cartel. Furthermore, it’s a partnership between the bankers and politicians

- Why we have not seen hyperinflation (yet)

- The system has changed from a free enterprise, competitive system to a politically connected, non-productive system, which will inevitably lead to totalitarianism

- The possibilities for America to reverse course and avoid catastrophe

Follow on Twitter

Follow on Twitter

Recent Comments