The following video was published by ChrisMartensondotcom on Nov 8, 2014

Energy is the lifeblood of any economy. But when an economy is based on an exponential debt-based money system and that is based on exponentially increasing energy supplies, the supply of that energy therefore deserves our very highest attention.

Did Gold and Silver Just Get Their ‘Greenspan Put’?

The world’s central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines – just when precious metals SHOULD have been soaring in response to near-global debt monetization.

The world’s central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines – just when precious metals SHOULD have been soaring in response to near-global debt monetization.

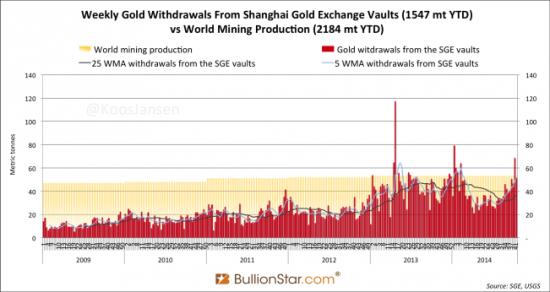

But something interesting happened as this latest smack-down really got going. Physical buyers – who goldbugs have for years been expecting to ride to the rescue, finally did. Chinese and Indian gold imports, which had trailed off earlier in the year, soared in response to the recent price declines. There’s some debate about exactly how much these guys are buying, but it certainly looks like they’re talking all that’s being produced by the world’s mines, and then some.

Here’s a chart from gold analyst Koos Jansen showing Chinese imports spiking lately:

This post was published at DollarCollapse on November 7, 2014.

The Government’s Manipulated Job Numbers Will Not Stop The Economic Collapse – Episode 512

The following video was published by X22Report on Nov 7, 2014

Gold Daily and Silver Weekly Charts – Short Squeeze

“Oh what a tangled web we weave, When first we practise to deceive!”

“Oh what a tangled web we weave, When first we practise to deceive!”

Walter Scott, Marmion, Canto vi, Stanza 17

Watching the trade in gold and silver last night was interesting.

Around midnight gold was smacked down seven dollars to about $1132 in the matter of a few seconds. That is customary since traders have to reset their stops after midnight, and there was a bit of the usual inexplicable ‘gamesmanship’ one sees in bucket shops, rigged card games, and for some reason the Comex.

But about an hour later the price rebounded back up sharply to the 1144 area and seemed to stick there for most of the trade, with a slight upward bias, until the US announced its Non-Farm Payrolls Report for October, which sucked out loud.

There is no recovery. And as that fantasy wavered, so did the dollar and both gold and silver traded higher throughout the day, as the spec who came for the usual NFP Day smackdown ate their shorts.

So what next. Gold and silver are still in bear markets. This is counterintuitive of course since in the case of gold especially there is a yawning mismatch between actually supply and real demand.

I took a look at the Sprott Physical Gold Trust and there it was, another redemption. I have not yet looked but I suspect we will see more sizable redemptions from the ETFs.

This post was published at Jesses Crossroads Cafe on 07 November 2014.

Gold Seeker Weekly Wrap-Up: Gold and Silver Rally Back Higher Friday to End Mixed on the Week

The Metals:

The Metals:

Gold fell almost 1% in Asia and held near unchanged in London, but it then climbed steadily higher for most of trade in New York and ended near its last minute high of $1177.33 with a gain of 2.78%. Silver slipped to $15.06 in Asia, but it then climbed to as high as $15.79 in New York and ended with a gain of 1.88%.

Euro gold rose to about 944, platinum gained $20 to $1213, and copper climbed 3 cents to about $3.04.

Gold and silver equities rose throughout most of trade and ended with about 7.5% gains.

This post was published at GoldSeek on 7 November 2014.

Metals Insider Shares Alarming News about Mine Supply in Exclusive Interview

The following video was published by silver investor.com on Nov 7, 2014

Late-Day Stock-Buying Panic “Proves” Jobs Data Was “Great”

Stocks end the week on a weaker note roundtripping off premature exuberance into the European close after jobs data that missed expectations (or did they). Of course the kneejerk response took the S&P and Dow to record highs before the weakness set in. Thanks to a late day panic-buying rip though, Nasdaq and Russell 2000 close the week unch – no need to call Mr. Bullard. Treasury yields collapsed today, ending the week down around 3-4bps. The USD sold off today to close the week up 0.6% with JPY and AUD the weakest against the greenback on the week. Gold (and silver) rallied to close the week almost unchanged. Interestingly, despite VIX’s best efforts (almost breaking under 13), stocks rolled over this afternoon (then ripped). Oil prices pushed modestly higher early on and ended the day around $78.50. The ubiquitous Friday late-day buying panic ripped everything higher – on absolutely no news – “proving” that the jobs data was great (expect, why were safe haven bond and bullion so heavily bid?)

Stocks end the week on a weaker note roundtripping off premature exuberance into the European close after jobs data that missed expectations (or did they). Of course the kneejerk response took the S&P and Dow to record highs before the weakness set in. Thanks to a late day panic-buying rip though, Nasdaq and Russell 2000 close the week unch – no need to call Mr. Bullard. Treasury yields collapsed today, ending the week down around 3-4bps. The USD sold off today to close the week up 0.6% with JPY and AUD the weakest against the greenback on the week. Gold (and silver) rallied to close the week almost unchanged. Interestingly, despite VIX’s best efforts (almost breaking under 13), stocks rolled over this afternoon (then ripped). Oil prices pushed modestly higher early on and ended the day around $78.50. The ubiquitous Friday late-day buying panic ripped everything higher – on absolutely no news – “proving” that the jobs data was great (expect, why were safe haven bond and bullion so heavily bid?)

This happened…

This post was published at Zero Hedge on 11/07/2014.

5 Things To Ponder: GOP Takes Control

This past Tuesday the conservative Republican candidates garnered a resounding victory over their Democratic challengers in even some of the “bluest” states. The message that was sent by voters was quite clear: “The real economy sucks.”

Despite headline statistics, for 80% of American’s the real economy remains quite weak with income growth and quality job opportunities scarce. Accordingly, since most voters are generally uniformed about which candidate is running on which platform, the majority vote by the way they “feel” at the time of election. If things are good, they tend to vote for incumbents. If not, they vote for “change.”

This weekend’s variety of views and opinions on what Tuesday’s election blowout means to the economy and the financial markets. Is it a sign of better things ahead or the beginning of the end of the current “bull market?”

But let’s start with a bit of humor before we get we get into the serious stuff. (Warning: Strong language)

This post was published at StreetTalkLive on 06 November 2014.

Greenspan’s Stunning Admission: “Gold Is Currency; No Fiat Currency, Including the Dollar, Can Match It”

For some reason, the Council of Foreign Relations, where ex-Fed-Chief Alan Greenspan spoke last week, decided the following discussion should be left out of the official transcript. We can perhaps understand why… as Gillian Tett concludes, “comments like that will be turning you into a rock star amongst the gold bug community.”

This post was published at Zero Hedge on 11/07/2014.

Silver Price Extremes!

To identify ‘buying opportunities’ in ‘extreme’ situations, we identify historical extreme situations and use them for a benchmark. Provided that a correction occurs in an active bull market, the insights from this kind of analysis can be very helpful.

To identify ‘buying opportunities’ in ‘extreme’ situations, we identify historical extreme situations and use them for a benchmark. Provided that a correction occurs in an active bull market, the insights from this kind of analysis can be very helpful.

Most should agree that the credit crisis was a major economic event that pushed nearly all assets down to an extreme low. We have used this kind of extraordinary market action as a comparison for the current commodities correction.

In the above chart we simply measured the percentage drop of the current correction and compared it to the extreme drop back in 2008. Based on this chart it is safe to say that the current correction could be considered extreme.

This post was published at SilverSeek on November 7th, 2014.

Keynesian Dogma – Garbage In, Garbage Out

Janet Yellen Bemoans ‘Lack of Fiscal Support’ Fed chair Janet Yellen studied under the Keynesian James Tobin, whose name is nowadays best known for being associated with a tax. It should therefore not come as a big surprise that she supports Keynesian dogma regarding government intervention in what is left of the market economy.

Janet Yellen Bemoans ‘Lack of Fiscal Support’ Fed chair Janet Yellen studied under the Keynesian James Tobin, whose name is nowadays best known for being associated with a tax. It should therefore not come as a big surprise that she supports Keynesian dogma regarding government intervention in what is left of the market economy.

As Reuters reports:

‘U. S. Federal Reserve Chair Janet Yellen on Friday called on politicians across the globe to get their fiscal houses in order during good times to prop up economies during times of turmoil.

In remarks to a symposium in Paris, Yellen blamed part of the slow global economic recovery on weak government support.

She took aim at both U. S. political gridlock after the 2007-2009 financial crisis and the austere policies across Europe as the region struggles with persistently low inflation.

The crisis led major central banks to deploy unconventional tools to spur recovery. For its part, the Fed cut interest rates to zero and more than quadrupled its balance sheet to $4.4 trillion through three rounds of bond buying, eliciting howls of protest from some politicians who feared the monetary largesse would spark an unwanted inflation. It announced an end to its latest asset purchase program just last week.

While the unconventional tools helped support domestic recovery and global economic growth, more action from fiscal authorities would have strengthened the recovery, Yellen said.

‘In the United States, fiscal policy has been much less supportive relative to previous recoveries,’ she said during a panel discussion at the Bank of France. Yellen cited data that compared the large increase in U. S. government payrolls after the 2001 recession to the decline of 650,000 government jobs after 2008.

AS central banks seek to promote healthy economies, she said a sharpened focus on financial stability would play a key role. Yellen did not comment on U. S. monetary policy, specifically, but said central banks globally would need to normalize policy as economic activity and inflation return to normal. The timing and speed of policy normalization will vary across countries, Yellen added, and could lead to financial volatility.’

This post was published at Acting-Man on November 7, 2014.

Best Day For Gold Since September 2013

Following a heavy volume flush and reversal around midnight ET, gold prices surged today. The 3.3% rally is the best day since September 2013.

Following a heavy volume flush and reversal around midnight ET, gold prices surged today. The 3.3% rally is the best day since September 2013.

Best day in 14 months…

This post was published at Zero Hedge on 11/07/2014.

Close to the Bottom but Not There Yet

The selloff in precious metals intensified over the past week. GDXJ declined 25% in seven days while Gold plunged below $1180 to $1140 and Silver plunged below $16 and to as low as $15.20. Precious metals are becoming extremely oversold and the bear market is clearly in the 9th inning. Be on alert for a snapback rally to repair the extreme oversold conditions. Although we are likely very close to the bottom in the miners, Gold’s current position continues to leave me skeptical.

The selloff in precious metals intensified over the past week. GDXJ declined 25% in seven days while Gold plunged below $1180 to $1140 and Silver plunged below $16 and to as low as $15.20. Precious metals are becoming extremely oversold and the bear market is clearly in the 9th inning. Be on alert for a snapback rally to repair the extreme oversold conditions. Although we are likely very close to the bottom in the miners, Gold’s current position continues to leave me skeptical.

Below is the updated bear analog for Gold which uses weekly data. Gold has yet to suffer the extreme selling experienced by Silver and the mining stocks. It makes sense given that Gold peaked months after those assets. The chart illustrates how bear markets are a function of price and time. The most severe bears in price are the shortest in time while the longest bears in terms of time are the least severe in terms of price. This bear falls in between. Given that Gold went 10 years without a real bear market it makes sense that this bear could bottom very close to the 1983-1985 and 1975-1976 bears but will have lasted quite a bit longer.

With respect to Gold, another point to consider is the strong supports at $1080/oz (50% retracement of the bull market) as well as $1000/oz. These downside targets continue to align well with the history depicted in the bear analog chart. Moreover, the fact that Gold currently sits well above these support levels is reason to expect more downside.

Silver on the other hand figures not to have the same degree of downside. Silver’s bear began five months before Gold’s and the bear analog below makes a strong case that the current bear will end very soon.

This post was published at GoldSeek on 7 November 2014.

Bob Murphy: The Fed’s Stock Market Casino

The following video was published by misesmedia on Nov 7, 2014

Jeff Deist and Robert P. Murphy address the vital topic of Fed interference in financial markets. Are the global equity and bond markets a charade, engineered by monetary expansion and destined to collapse like a house of cards? Is the investing game basically rigged? How can Janet Yellen and financial elites keep markets from crashing without endless new rounds of quantitative easing? Why is understanding Austrian economics necessary, but not sufficient, to be a successful investor? And how would stock markets have a social function in a free society? Anyone interested in investing, personal finance, Austrian economics, and the wit and wisdom of Bob Murphy will enjoy this show.

Democracy Now Interview Matt Taibbi and the JPM Whistleblower

You may read a transcript of the interview on DemocracyNow here.

You may read a transcript of the interview on DemocracyNow here.

I wonder who Amy will interview when the currency markets go sideways, and gold and silver go rocketing higher, with Banks whining for bailouts as ‘they stare into the abyss.’

This post was published at Jesses Crossroads Cafe on 07 NOVEMBER 2014.

Russia & China Vs. USA – Bud Conrad Interview, Casey Research

The following video was published by VictoryIndependence on Nov 7, 2014

The New Normal: From $1 Billion IPO To Bankruptcy In 6 Months

“Surprises like this are poison to the stock market, and this is one of the big surprises,”exclaims the head of listing for Nasdaq’s Copenhagen exchange as OW Bunker A/S – a marine fuel bunker company – went from $1 billion-plus IPO in April to bankruptcy today.

“Surprises like this are poison to the stock market, and this is one of the big surprises,”exclaims the head of listing for Nasdaq’s Copenhagen exchange as OW Bunker A/S – a marine fuel bunker company – went from $1 billion-plus IPO in April to bankruptcy today.

From $1billion IPO to bankruptcy in just over 6 months…

This post was published at Zero Hedge on 11/07/2014.

It’s All Come Down To This

What really matters… “It’s time to be invested… the correction is over… we’ve got good jobs number[which was a miss], GDP is there [which is being revised lower each day], earnings are there [which have been revised drastically lower for the rest of 2014 and 2015]… and even if we do get a dip down, we’ve got Mr Bullard to come in and reassure the markets…”

What really matters… “It’s time to be invested… the correction is over… we’ve got good jobs number[which was a miss], GDP is there [which is being revised lower each day], earnings are there [which have been revised drastically lower for the rest of 2014 and 2015]… and even if we do get a dip down, we’ve got Mr Bullard to come in and reassure the markets…”

This post was published at Zero Hedge on 11/07/2014.

A Tale of Two Markets: Gold Market Manipulation in NY and London

“It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes… There are no necessary evils in government. Its evils exist only in its abuses. If it would confine itself to equal protection, and, as Heaven does its rains, shower its favors alike on the high and the low, the rich and the poor, it would be an unqualified blessing.”

“It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes… There are no necessary evils in government. Its evils exist only in its abuses. If it would confine itself to equal protection, and, as Heaven does its rains, shower its favors alike on the high and the low, the rich and the poor, it would be an unqualified blessing.”

Andrew Jackson, Veto Message of the Second Central Bank of the United States

Thanks to two hard working and exceptionally clever analysts, we have a clear picture of the regularity with which the world price of gold has been manipulated by paper trading in New York and London.

Nick Laird, the data wrangler of Sharelynx, com, has constructed a five year rolling average of price movements for gold throughout the day. Given that this is five years worth of data, it would be very difficult to say that it is some sort of anomaly.

And thanks also to Dave Kranzler, of Investment Research Dynamics, who has been insightful in his markings on the chart to show the significance of the price movements. Dave manages a hedge fund specializing in precious metals, and also offers research reports on mining companies which is his area of greatest investment interest.

I have added a few things to Dave’s work, because compared to the Denver bronco I am a bit more challenged by age in reading small, pale type on charts.

As you can see on the chart below, gold almost invariably rises during Asian trading hours, where the predominantly physical trade is engage in the price discovery of bullion.

After the Asian trading markets close, gold typically begins a precipitous drop, culminating in an initial bottom around the London AM fix.

The London price fix (fix, what an ironically appropriate name in American slang) is conducted in the United States dollar (USD), the Pound sterling (GBP), and the Euro (EUR) daily at 10.30am and 3pm, London time. The fix used to be conducted in meetings on the premises of N. M. Rothschild & Sons by the members of The London Gold Market Fixing Ltd. In 2004 Rothschild exited that position in London, and sold its seat in the operation to Barclays Bank.

Since that time the AM and PM Gold Fix have been set on a private conference call by Barclays, HSBC, Socit Gnrale, and Scotia-Mocatta.

This post was published at Jesses Crossroads Cafe on 07 NOVEMBER 2014.

Meet The (First) Seven Banks Who Rigged The FX Market

Several years ago, anyone who suggested there was a massive Libor manipulation conspiracy was branded as, what else, a tin-foil fringe lunatic: after all “how can so many people possibly collude in complete secrecy?” And then it was revealed that for years, there was a massive Libor manipulation conspiracy.

Several years ago, anyone who suggested there was a massive Libor manipulation conspiracy was branded as, what else, a tin-foil fringe lunatic: after all “how can so many people possibly collude in complete secrecy?” And then it was revealed that for years, there was a massive Libor manipulation conspiracy.

Now, even though it has been extensively leaked in advance, we are about to get the next market rigging “conspiracy theory” become fact, after countless traders working for major banks and conspiring in secret chatrooms such as “The Cartel” and the “Bandits” are about to cost their employers billions in settlement charges as regulators after regulator and country after country charges the world’s biggest, and most criminal banks, with billions for manipulating their currency for years.

As the WSJ reports, “Regulators in the U. S. and U. K. are nearing a deal with as many as seven large banks to resolve allegations of misconduct in the currencies market, with a settlement likely in the next two weeks, according to people familiar with the negotiations.

This post was published at Zero Hedge on 11/07/2014.

Follow on Twitter

Follow on Twitter

Recent Comments