This post was published at Market-Ticker on Nov 24, 2014.

‘High-End Housing Is Going To Get Slaughtered’

The title quote is from a colleague who has been monitoring the upper-end housing areas in the metro-Denver area every day for the last year. Neighborhoods in which there is a preponderance of homes valued over $750k have been flooded with listings. Here’s a perfect example:

The title quote is from a colleague who has been monitoring the upper-end housing areas in the metro-Denver area every day for the last year. Neighborhoods in which there is a preponderance of homes valued over $750k have been flooded with listings. Here’s a perfect example:

The areas marked off are high-end neighborhoods adjacent to the Denver Tech Center, which hosts many Denver-based tech and energy companies. It’s also adjacent to one of the largest hospital/medical services complexes in the metro-Denver area. My colleague said that six months ago there was not much for sale in these two areas and homes sold quickly. As it turns out, Toll Brothers builds a lot of new homes and has a lot of available inventory in this area as well. Toll is one of my favorite short plays.

Here’s another great example:

This post was published at Investment Research Dynamics on November 24, 2014.

Eine Mitteilung an das Schweizer Volk – Mike Maloney (A Message To The People Of Switzerland)

The following video was published by Mike Maloney on Nov 24, 2014

EU Mandarins Want to ‘Break Up Google’ – Commissar Oettinger Strikes Again

A Fount of Bad Ideas We have previously reported on the EU’s new digital commissar Mr. Oettinger, who has recently announced he wants to make an EU case against Google a ‘model case’ for the EU’s approach to large companies serving the inter-tubes. Naturally, the entire convocation of busybodies in Brussels is all for this bizarre idea.

A Fount of Bad Ideas We have previously reported on the EU’s new digital commissar Mr. Oettinger, who has recently announced he wants to make an EU case against Google a ‘model case’ for the EU’s approach to large companies serving the inter-tubes. Naturally, the entire convocation of busybodies in Brussels is all for this bizarre idea.

The today still widely accepted theory of monopoly has been throroughly refuted in its entirety by Murray Rothbard’s contribution in ‘Man, Economy and State’ (pdf; see chapter 10: ‘Monopoly and Competition’). Naturally, this contribution has been widely ignored in spite of its originality and importance, mainly because it implies that there is no cause for government intervention to ‘rein in monopolies’ whatsoever. In other words, the EU’s ‘competition commission’ is really superfluous.

The idea to break up Google is moreover based on the utterly absurd notion that EU companies that don’t even exist need to be ‘protected’.

Reuters reports:

‘The European Parliament is preparing a non-binding resolution that proposes splitting Google Inc’s search engine operations in Europe from the rest of its business as one possible option to rein in the Internet company’s dominance in the search market.

European politicians have grown increasingly concerned about Google’s and other American companies’ command of the Internet industry, and have sought ways to curb their power. A public call for a break-up would be the most far-reaching action proposed and a significant threat to Google’s business.

The draft motion does not mention Google or any specific search engine, though Google is by far the dominant provider of such services in Europe with an estimated 90 percent market share. Earlier on Friday, the Financial Times described a draft motion as calling for a break-up of Google. Google declined to comment.

The motion seen by Reuters ‘calls on the Commission to consider proposals with the aim of unbundling search engines from other commercial services as one potential long-term solution’ to leveling the competitive playing field.

This post was published at Acting-Man on November 24, 2014.

The Federal Reserve Is At The Heart Of The Debt Enslavement System That Dominates Our Lives

From the dawn of history, elites have always attempted to enslave humanity. Yes, there have certainly been times when those in power have slaughtered vast numbers of people, but normally those in power find it much more beneficial to profit from the labor of those that they are able to subjugate. If you are forced to build a pyramid, or pay a third of your crops in tribute, or hand over nearly half of your paycheck in taxes, that enriches those in power at your expense. You become a ‘human resource’ that is being exploited to serve the interests of others. Today, some forms of slavery have been outlawed, but one of the most insidious forms is more pervasive than ever. It is called debt, and virtually every major decision of our lives involves more of it. For example, at the very beginning of our adult lives we are pushed to go to college, and Americans have piled up more than 1.2 trillion dollars of student loan debt at this point. When we buy homes, most Americans get mortgages that they can barely afford, and when we buy vehicles most Americans now stretch their loans out over five or six years. When we get married, that often means even more debt. And of course no society on Earth has ever piled up more credit card debt than we have. Almost all of us are in bondage to debt at this point, and as we slowly pay off that debt over the years we will greatly enrich the elitists that tricked us into going into so much debt in the first place. At the apex of this debt enslavement system is the Federal Reserve. As you will see below, it is an institution that is designed to produce as much debt as possible.

From the dawn of history, elites have always attempted to enslave humanity. Yes, there have certainly been times when those in power have slaughtered vast numbers of people, but normally those in power find it much more beneficial to profit from the labor of those that they are able to subjugate. If you are forced to build a pyramid, or pay a third of your crops in tribute, or hand over nearly half of your paycheck in taxes, that enriches those in power at your expense. You become a ‘human resource’ that is being exploited to serve the interests of others. Today, some forms of slavery have been outlawed, but one of the most insidious forms is more pervasive than ever. It is called debt, and virtually every major decision of our lives involves more of it. For example, at the very beginning of our adult lives we are pushed to go to college, and Americans have piled up more than 1.2 trillion dollars of student loan debt at this point. When we buy homes, most Americans get mortgages that they can barely afford, and when we buy vehicles most Americans now stretch their loans out over five or six years. When we get married, that often means even more debt. And of course no society on Earth has ever piled up more credit card debt than we have. Almost all of us are in bondage to debt at this point, and as we slowly pay off that debt over the years we will greatly enrich the elitists that tricked us into going into so much debt in the first place. At the apex of this debt enslavement system is the Federal Reserve. As you will see below, it is an institution that is designed to produce as much debt as possible.

There are many people out there that believe that the Federal Reserve is an ‘agency’ of the federal government. But that is not true at all. The Federal Reserve is an unelected, unaccountable central banking cartel, and it has argued in federal court that it is ‘not an agency’ of the federal government and therefore not subject to the Freedom of Information Act. The 12 regional Federal Reserve banks are organized ‘much like private corporations’, and they actually issue shares of stock to the ‘member banks’ that own them. 100 percent of the shareholders of the Federal Reserve are private banks. The U. S. government owns zero shares.

Many people also assume that the federal government ‘issues money’, but that is not true at all either. Under our current system, what the federal government actually does is borrow money that the Federal Reserve creates out of thin air. The big banks, the ultra-wealthy and other countries purchase the debt that is created, and we end up as debt servants to them.

This post was published at The Economic Collapse Blog on November 24th, 2014.

The Swiss Referendum On Gold: What’s Missing From The Debate

This article is written by Eric Schreiber, independent asset manager, former head of commodities UBP, former head of precious metals Credit Suisse Zurich. All views expressed are his and may not reflect those of his former employers.

This article is written by Eric Schreiber, independent asset manager, former head of commodities UBP, former head of precious metals Credit Suisse Zurich. All views expressed are his and may not reflect those of his former employers.

The Swiss will vote on a referendum on November 30th that would ban the Swiss National Bank (SNB) from selling current and future gold reserves, repatriate foreign stored gold holdings to Switzerland, and mandate that gold must comprise a minimum of 20% of central bank assets. The SNB does not usually comment on political referendums. However, in this case it has done so quite vocally.

Why has the central bank decided to step into the political fray and oppose this initiative? What are its concerns? Are they valid or motivated by other factors?

The SNB’s primary objections to the gold initiative are three fold. 1) It claims that gold is ‘one of the most volatile and riskiest investments’, 2) that a 20% gold requirement will lower the ‘distributions to the confederation and the cantons’ since gold does not pay interest like bonds and dividend paying stocks, and 3) that the 20% gold holding requirement will interfere with its ability to conduct monetary policy and complicate efforts to maintain ‘the minimum exchange rate’, the ‘temporary’ policy of pegging the Swiss franc (CHF) to the Euro (EUR) it initiated in 2011 and continues to enforce to this day.

The first two concerns can quickly be addressed and discounted. Gold is indeed a volatile asset at times but so are bonds and equities. In recent years Greek, Spanish, Italian, Irish and other European bonds have been far more volatile than gold. The SMI, the Swiss stock index, lost over 50% of its value on two separate occasions between 2000 and 2009 while gold steadily rose at an annual rate of 8.50% over the same period.

Regarding the second concern, the distribution of proceeds derived from financial speculation and paid to the confederation and cantons, one has to question whether or not it is really appropriate for the SNB to re-brand itself as a hedge fund instead of remaining focused on its core responsibilities as a central bank.

To properly address the third SNB concern requires a historical context and a more detailed analysis. Prior to the change in the Swiss constitution, the CHF was backed by a minimum amount of 40% gold. Despite this constraint, Swiss monetary policy at the SNB was unhindered and functioned properly during the post World War II period. The SNB is correct in implying that today a partial gold backing, as required by the referendum, would make its policy of weakening the CHF against the EUR more difficult. Although the SNB has raised the currency peg as a reason for voting against the referendum the issue has not been directly addressed by the ‘YES’ camp. Is the peg necessary? Does the population in Switzerland benefit as a whole from a weak EURCHF exchange rate? Why does the SNB feel compelled to continue a policy that it characterized over 3 years ago as ‘temporary’? How did ‘the minimum exchange rate’ policy come to be? Why hasn’t there been a public debate about it?

This post was published at GoldSilverWorlds on November 24, 2014.

Currency Wars Reignite As Yuan Tumbles Most In 2 Months And Chinese Bond Market Freezes

Did China just re-enter the currency wars? The Chinese Yuan dropped 0.29% overnight – its biggest drop since September and 2nd biggest devaluation since March – as the currency tumbles back in line with the PBOC’s fixing for the first time in over 3 months. Despite ‘hopes’, S&P confirms the recent (and reconfirmed) rate cut doesn’t signal renewed government intentions to resort to aggressive stimulus to prop up economy. More troubling is the fact that China’s huge corporate debt market appears to be freezing as over $1.2 billion in bond sales were scrapped or delayed last week suggesting wall of maturing debt will find it increasingly difficult to roll-over and keep the dream alive (especially in light of Haixin’s bankruptcy last week).

Did China just re-enter the currency wars? The Chinese Yuan dropped 0.29% overnight – its biggest drop since September and 2nd biggest devaluation since March – as the currency tumbles back in line with the PBOC’s fixing for the first time in over 3 months. Despite ‘hopes’, S&P confirms the recent (and reconfirmed) rate cut doesn’t signal renewed government intentions to resort to aggressive stimulus to prop up economy. More troubling is the fact that China’s huge corporate debt market appears to be freezing as over $1.2 billion in bond sales were scrapped or delayed last week suggesting wall of maturing debt will find it increasingly difficult to roll-over and keep the dream alive (especially in light of Haixin’s bankruptcy last week).

This post was published at Zero Hedge on 11/24/2014.

The Dutch Central Bank Brings 120 tonnes of Gold Back to Amsterdam from New York

The Dutch central bank has secretly brought a large part of the national gold reserves being held in a secure depot in New York back to Amsterdam.

The Dutch central bank has secretly brought a large part of the national gold reserves being held in a secure depot in New York back to Amsterdam.

In total, 120 tonnes of gold valued at 4bn has been brought back to the Netherlands by ship, Nos television said.

The high security reparations for the move took months.

The central bank decided to bring some of its gold reserves back to the Netherlands to ensure a better spread, the bank said in a statement.

In addition, the bank hopes to boost consumer confidence by showing there is enough gold in the Netherlands to take the country through a new economic crisis.

Now 31% of the Dutch gold reserves are in Amsterdam, the same percentage as in New York. The rest is in Ottowa and London.

The Netherlands has 612 tonnes of gold – worth 19bn at current gold prices, Nos said.

This post was published at Gold Broker on Nov 21, 2014.

Gold Confiscation, Windfall Taxes? | Duane & Hoffman (Part 3)

The following video was published by FinanceAndLiberty.com on Nov 24, 2014

Gold Daily and Silver Weekly Charts – Quiet Options Expiration on the Comex

Today was the last option expiration for 2014 Comex precious metal options.

Today was the last option expiration for 2014 Comex precious metal options.

Gold and silver were under slight pressure most of the day, but closed largely unchanged. Gold was down about five dollars while silver was up a penny.

Let’s see how the trade winds down this week.

A nor’easter is expected to work its way up the east coast of the US this week. There is some uncertainly but we may be seeing a substantial winter storm in the New Jersey-New York-New England area on Wednesday, so I would expect the adults to leave on Tuesday for a long holiday weekend. The Wednesday before Thanksgiving is the biggest travel day of the year.

This post was published at Jesses Crossroads Cafe on 24 NOVEMBER 2014.

US Troops Remain In Poland And The Baltic States For WWIII- Episode 526

The following video was published by X22Report on Nov 24, 2014

Business activity tumbles to 7 month lows. More Americans can not make the payments on their cars and delinquencies are rising. The Netherlands wants their gold back and other countries will follow. 40 countries will be joining the Eurasian Union. Another banker has been found dead. Ferguson grand jury has made a decision, be prepared for an event to go hot. US keeping troops in Poland and the Baltic States in preparation for the next war. Ukraine suspends coal delivery from Russia. Unidentified jet bombs again in Libya. New malware discovered that is extremely advanced and can see everything on all systems. NORAD planning to fly over the capital with F–16s.

Global Business Confidence Collapses To Post-Lehman Lows

As we noted here, despite record high stock prices and talking-heads imploring investors to believe CEOs are confident, they are not (consider the clear indication of a lack of economic confidence from tumbling capex and soaring buybacks), That is further confirmed today as Markit’s survey of over 6000 firms showed optimism falling sharply in October, dropping to the lowest seen since the survey began five years ago. Hiring and investment plans were also at or near post-crisis lows, while price expectations deteriorated further. More worrying, perhaps, is the US is not decoupled whatsoever, with future expectations of US business activity at the lowest since the financial crisis.

As we noted here, despite record high stock prices and talking-heads imploring investors to believe CEOs are confident, they are not (consider the clear indication of a lack of economic confidence from tumbling capex and soaring buybacks), That is further confirmed today as Markit’s survey of over 6000 firms showed optimism falling sharply in October, dropping to the lowest seen since the survey began five years ago. Hiring and investment plans were also at or near post-crisis lows, while price expectations deteriorated further. More worrying, perhaps, is the US is not decoupled whatsoever, with future expectations of US business activity at the lowest since the financial crisis.

This post was published at Zero Hedge on 11/24/2014.

Twitter “Hedge Fund Manager” Anthony Davian Sentenced To 4 Years 9 Months In Federal Prison

a year ago we reported that one of Twitter early and most aggressive self-promoters, Anthony Davian, was busted for what was at the time financial Twitters’ the first Ponzi Scheme. In our words then:

a year ago we reported that one of Twitter early and most aggressive self-promoters, Anthony Davian, was busted for what was at the time financial Twitters’ the first Ponzi Scheme. In our words then:

Once upon a time there was a Twitter-based, pump-and-dumping daytrading bucket shop posing as a “successful hedge fund manager” also known as Davian Letter/Davian Capital Advisors run by an Ohio gentleman known as Anthony Davian, which for reasons unknown even managed to run outside capital (somehow raking up to $1.5 million in idiot AUM, mostly courtesy of his very aggressive self promotion on Twitter using the @hedgieguy handle), and which didn’t like Zero Hedge much.

(but that’s ok because the feeling was mutual – we had advised the SEC in late 2009 that the Davian operation was nothing but a ponzi scheme).

A few years later, said outside capital is gone (with losses that could have been prevented had the SEC moved earlier) and moments ago, following a four year delay since our notice, the SEC has finally acted and charged Anthony Davian with fraud.

Today, we can close the case on Athony Davian.

As SIRF reports, “Anthony Davian, a once-prolific presence on social media who held himself out as a iconoclastic hedge fund manager prior to his August 2013 indictment on a series of fraud charges, was sentenced several hours ago in a Cleveland courtroom to four years and nine months in federal prison.”

The details of the sent

This post was published at Zero Hedge on 11/24/2014.

Another Keynesian Debt Boondoggle: How Brussels Plans To Turn $26 Billion Into $390 Billion

The desperation and fraud of the Keynesian policy apparatus gets more stunning by the day. Apparently, the pettifoggers in Brussels will soon be announcing a new $400 billion bazooka to blast the euro-economy out of its lethargy. This massive new ‘stimulus’ is supposed to spur all manner of infrastructure and private investment that is purportedly bottled-up for want of cheap capital in the private markets.

The desperation and fraud of the Keynesian policy apparatus gets more stunning by the day. Apparently, the pettifoggers in Brussels will soon be announcing a new $400 billion bazooka to blast the euro-economy out of its lethargy. This massive new ‘stimulus’ is supposed to spur all manner of infrastructure and private investment that is purportedly bottled-up for want of cheap capital in the private markets.

Are they kidding? Thanks to the Draghi Put (‘whatever it takes’) and the hedge fund gamblers who have gone all-in front running the promised ECB bond-buying campaign, this very morning the corrupt and bankrupt government of Spain can borrow all the money it could possibly need for infrastructure at hardly 2.0% for ten years. And any healthy German exporter or machinery maker can borrow at a small spread off the German 10-year bond which is trading at 73 basis points. For all intents and purposes, sovereigns of any stripe and reasonably healthy businesses in most parts of Europe can access capital at central bank repressed rates which are tantamount to free money.

And, yet, these fools want to bring coals to Newcastle. Well, its actually worse than that because not only does Newcastle not need any coal, but the impending ‘Juncker Plan’ doesn’t include any new coal, anyway!

In fact, not a penny of the $400 billion is new EU cash: Its all about leverage and sleight-of-hand. Thus, having apparently failed to notice that most of the sovereigns which comprise the EU are already bankrupt, the Brussels bureaucrats plan to conjure this new ‘stimulus’ money at a 15:1 leverage ratio. That is to say, the actual ‘capital’ under-pinning approximately $375 billion in new EU borrowings amounts to only $26 billion.

But wait. The EU is self-evidently broke – that’s why its dunning Mr. Cameron and even its Greek supplicants for back taxes – so where is it going to get the $26 billion of ‘capital’? Needless to say, an empty treasury has never stopped Keynesian bureaucrats from dispensing the magic elixir of ‘stimulus’ money.

This post was published at David Stockmans Contra Corner on November 24, 2014.

Fed “Mystified” Why Millennials Still Live at Home; My Answer May Surprise You (It Isn’t Jobs, Student Debt, or Housing)

A New York Fed research paper wonders What’s Keeping Millennials at Home? Is it Debt, Jobs, or Housing?

A New York Fed research paper wonders What’s Keeping Millennials at Home? Is it Debt, Jobs, or Housing?

The paper says “it’s a mystery” why the housing recovery did not have a bigger impact on millennials living at home.

The research paper, written by Zachary Bleemer, Meta Brown, Donghoon Lee, and Wilbert van der Klaauw notes correlations to debt, jobs and housing.

Yet, “student debt only explains about 10% of the increase in parental coresidence since 2004, with another 10% being explained by house prices during the mid-2000s“.

I have the answer below, but first a few charts and notes on the charts.

Notes:

CCP is the Federal Reserve Bank of New York’s Equifax-Sourced Consumer Credit Panel CPS is the Current Population Survey, a joint effort between the Bureau of Labor Statistics and the Census Bureau

This post was published at Global Economic Analysis on November 24, 2014.

The Tragedy Of Propping Up The Matrix Of Lies

Wall Street is only one of several financial roach motels in what has become a giant slum of a global economy. Notional ‘money’ scuttles in for safety and nourishment, but may never get out alive. Tom Friedman of The New York Times really put one over on the soft-headed American public when he declared in a string of books that the global economy was a permanent installation in the human condition. What we’re seeing ‘out there’ these days is the basic operating system of that economy trying to shake itself to pieces.

Wall Street is only one of several financial roach motels in what has become a giant slum of a global economy. Notional ‘money’ scuttles in for safety and nourishment, but may never get out alive. Tom Friedman of The New York Times really put one over on the soft-headed American public when he declared in a string of books that the global economy was a permanent installation in the human condition. What we’re seeing ‘out there’ these days is the basic operating system of that economy trying to shake itself to pieces.

The reason it has to try so hard is that the various players in the global economy game have constructed an armature of falsehood to hold it in place – for instance the pipeline of central bank ‘liquidity’ creation that pretends to be capital propping up markets. It would be most accurate to call it fake wealth. It is not liquid at all but rather gaseous, and that is why it tends to blow ‘bubbles’ in the places to which it flows. When the bubbles pop, the gas will tend to escape quickly and dramatically, and the ground will be littered with the pathetic broken balloons of so many hopes and dreams.

All of this mighty, tragic effort to prop up a matrix of lies might have gone into a set of activities aimed at preserving the project of remaining civilized. But that would have required the dismantling of rackets such as agri-business, big-box commerce, the medical-hostage game, the Happy Motoring channel-stuffing scam, the suburban sprawl ‘industry,’ and the higher ed loan swindle. A

This post was published at Zero Hedge on 11/24/2014.

REALIST NEWS – Now the Swiss Want Their Gold Back

The following video was published by jsnip4 on Nov 24, 2014

Deutsche Bank’s Modest Proposal To Central Banks: “Purchase The Gold Held By Private Households”

From the bank that a few days ago informed us that “People Are Talking About Helicopter Money And Debt Cancellation Being The End Game“, comes the logical next step. Here it is, without commentary and the key section highlighted:

From the bank that a few days ago informed us that “People Are Talking About Helicopter Money And Debt Cancellation Being The End Game“, comes the logical next step. Here it is, without commentary and the key section highlighted:

From Deutsche bank Behavioral Finance: Daily Metals Outlook

Although gold market operators are currently pre-occupied with the prospect of the SNB finding itself obliged by referendum to buy large quantities of bullion, another central bank raised the same possibility yesterday: the ECB.

This post was published at Zero Hedge on 11/24/2014.

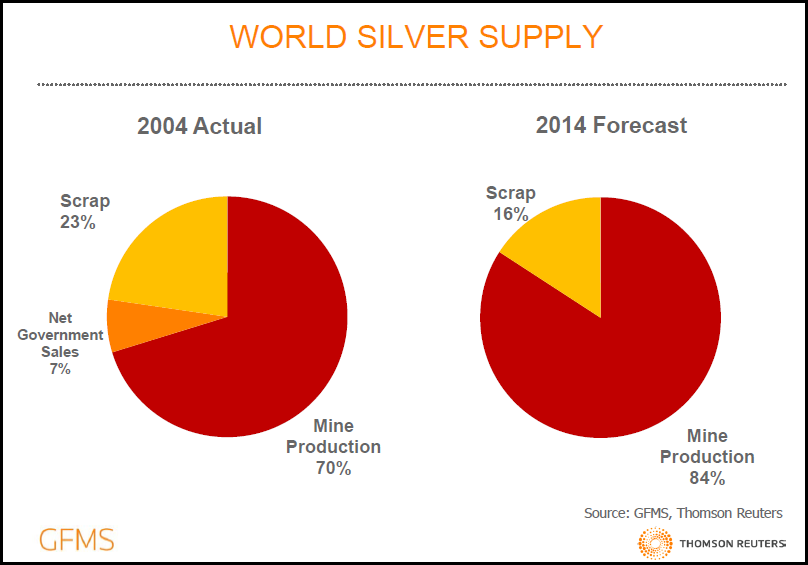

BREAKING: Significant Drawdown Of U.K. Silver Inventories Due To Record Indian Demand

There was a huge development in the silver market last week and how did the precious metal community respond? They basically ignored it. Go figure. So, I will try again to get the word out by presenting it in a different fashion.

There was a huge development in the silver market last week and how did the precious metal community respond? They basically ignored it. Go figure. So, I will try again to get the word out by presenting it in a different fashion.

Indian silver demand was so strong this year, that it produced a significant drawdown of U. K. silver inventories. Matter-a-fact, India had to access silver from China and Russia because available supplies from the U. K. were not sufficient.

According to GFMS Silver Interim Report released on Nov 18th:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totalling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

As you can see from GFMS statement, they even included the word ‘Massive’ to describe the demand coming from India. I emailed Andrew Leyland, GFMS silver analyst and author of the report, to see if he could put some figures behind the declining U. K. silver inventories. He was nice enough to respond today by stating the following:

The LBMA itself doesn’t hold any silver stocks, but its member companies do. These stocks may be unallocated or allocated (often allocated to ETF holdings) and GFMS survey these stock levels once a year ahead of the silver survey in May.

What we’ve heard so far in 2014 has been anecdotal, that there have been large drawdowns in the UK of unallocated material. This has been backed up by trade data that has seen India increasingly buying from China and Russia while the UK (as the traditional lead supplier to India) has lost market share. While we can’t quantify the drawdown or stock level at this point we thought it worth mentioning the trend. In addition, for the silver survey, we’ll be trying to survey how much material from European bullion stocks is allocated. Silver ETFs holdings have been robust, in comparison to gold, and this could effectively limit available inventory to the silver market moving forward.

This post was published at SRSrocco Report on November 24, 2014.

US Stocks Surge To ‘Best’ Streak In 86 years

The last few weeks have been the strongest and most consistent rallies in US equity market history. US equity markets have traded above their 5-day moving average for 27 days – the longest such streak since March 1928 (h/t MKM’s John Krinsky) and all amid GDP downgrades, missed PMIs, and downward earnings outlook revisions. Given the holiday week, it is hardly surprising volume was weak today. Stocks were very mixed today with Russell 2000 and Nasdaq leading the way (along with Trannies) as Dow and S&P showed very small gains – to record highs though. Bonds were also bid with a strong 2Y auction extending the drops in yields (0-2bps) led by 7Y. The USDollar fell 0.4% – led by EUR strength – as JPY, CAD, and AUD all weakened. Despite USD weakness, oil (big drop intraday), copper, and gold also dropped on the day with silver ending 0.25%. VIX dropped to 12.66 – its lowest close in over 2 months.

The last few weeks have been the strongest and most consistent rallies in US equity market history. US equity markets have traded above their 5-day moving average for 27 days – the longest such streak since March 1928 (h/t MKM’s John Krinsky) and all amid GDP downgrades, missed PMIs, and downward earnings outlook revisions. Given the holiday week, it is hardly surprising volume was weak today. Stocks were very mixed today with Russell 2000 and Nasdaq leading the way (along with Trannies) as Dow and S&P showed very small gains – to record highs though. Bonds were also bid with a strong 2Y auction extending the drops in yields (0-2bps) led by 7Y. The USDollar fell 0.4% – led by EUR strength – as JPY, CAD, and AUD all weakened. Despite USD weakness, oil (big drop intraday), copper, and gold also dropped on the day with silver ending 0.25%. VIX dropped to 12.66 – its lowest close in over 2 months.

This post was published at Zero Hedge on 11/24/2014.

Follow on Twitter

Follow on Twitter

Recent Comments