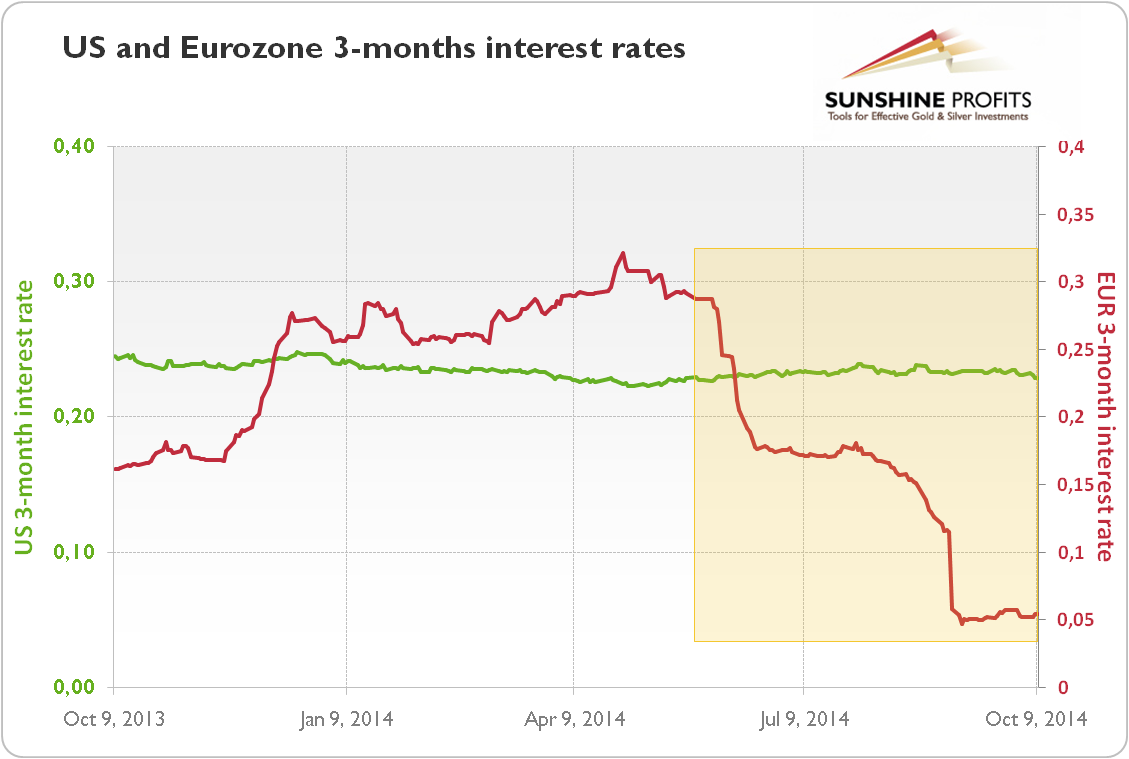

Understanding the relationship between the U. S. dollar and gold is necessary to successfully invest in gold. However, it is not sufficient, because changes in the USD exchange rates cannot be analyzed outside the economic context: gold, although not officially money, is traded like a currency. Therefore, long-term investors should not analyze the gold market in isolation or confine themselves to observe the U. S. dollar index. The price of gold reflects the complex financial world and hence depends on many factors: the movements of interest rates, inflation or economic growth. The U. S. dollar may rise due to many factors, each time affecting the price of gold in a slightly different way. In other words, if the USD and gold prices have an inverse relationship, then forecasts for gold prices should be prepared while taking into account the expectations of currency movement. To do this, we need to understand the factors driving the greenback.

Understanding the relationship between the U. S. dollar and gold is necessary to successfully invest in gold. However, it is not sufficient, because changes in the USD exchange rates cannot be analyzed outside the economic context: gold, although not officially money, is traded like a currency. Therefore, long-term investors should not analyze the gold market in isolation or confine themselves to observe the U. S. dollar index. The price of gold reflects the complex financial world and hence depends on many factors: the movements of interest rates, inflation or economic growth. The U. S. dollar may rise due to many factors, each time affecting the price of gold in a slightly different way. In other words, if the USD and gold prices have an inverse relationship, then forecasts for gold prices should be prepared while taking into account the expectations of currency movement. To do this, we need to understand the factors driving the greenback.

The financial press presents many explanations for U. S. dollar movements. Some analysts argue that changes in the balance of trade are responsible for strengths or weaknesses of the currency. However, balance of payments is only an accounting difference between the monetary value of what was sold versus the monetary value of what was bought, and thus cannot alter the external purchasing power of money. Other economists say that exchange rates depend upon economic health. However, the causality runs in the opposite direction. The strong currency is the condition of economic growth. Just consider the long-term relative position of the U. S. dollar. Generally, the greenback has been losing value compared to other major currencies (Japanese yen, Swiss franc and German mark or Euro now) since the 1970s, i.e. breaking the link with gold. However, two important exceptions occurred in the first half of 1980s and in the second half of 1990s.

This post was published at GoldSeek on 24 November 2014.

Follow on Twitter

Follow on Twitter

Recent Comments