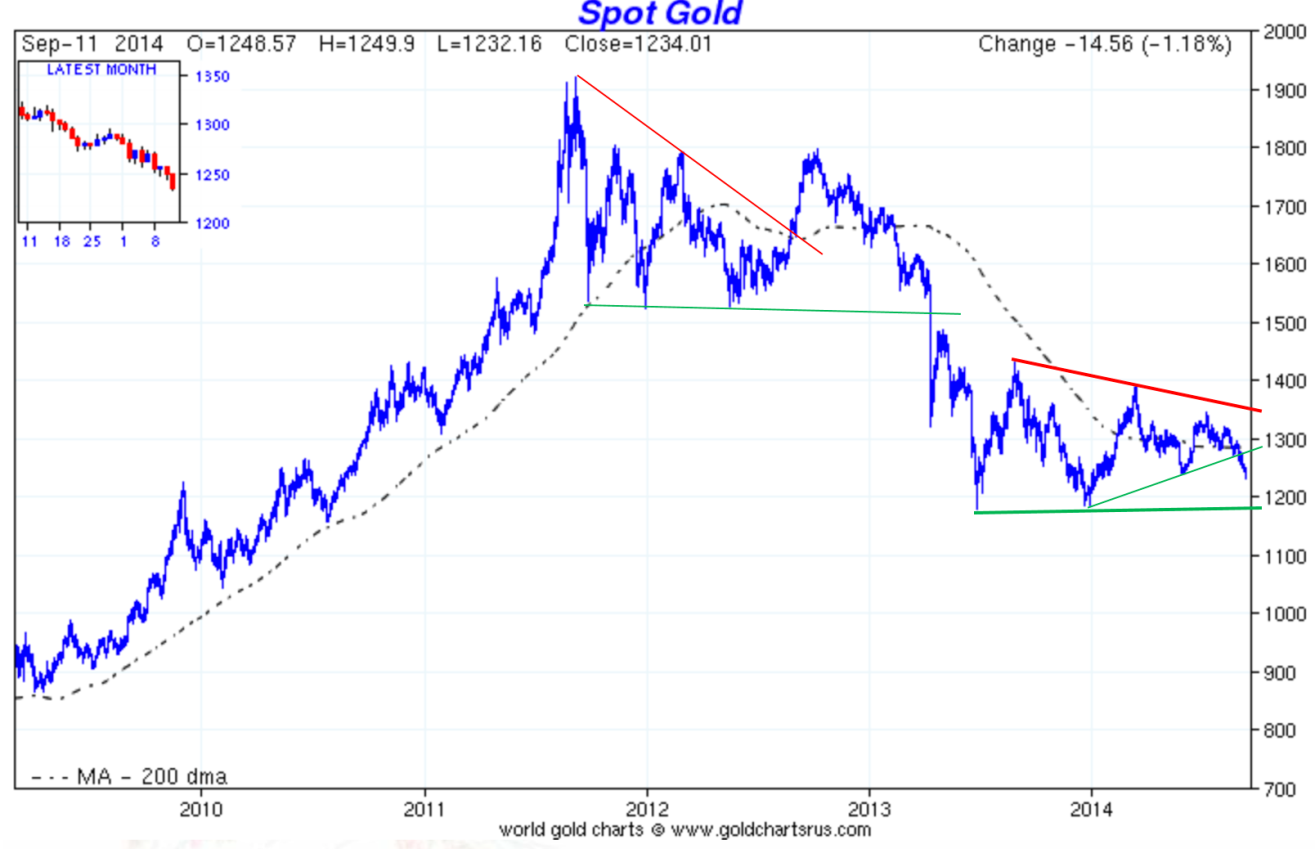

After the original drop in gold price from the top of $1,920 per ounce in 2011 to $1,180 per ounce in 2013, gold has started a sideways consolidation triangle pattern. Is this a correction, or is it just a pause within a move that will retrace the whole move since 2009? What does sentiment tell us?

After the original drop in gold price from the top of $1,920 per ounce in 2011 to $1,180 per ounce in 2013, gold has started a sideways consolidation triangle pattern. Is this a correction, or is it just a pause within a move that will retrace the whole move since 2009? What does sentiment tell us?

The gold market is a very opaque one and very hard to analyse. The amount of gold exchanging hands outside the markets is enormous. China seems to continue buying in a very discrete way and shows regularly, through speaches but also actions, that it considers gold at the core of its currency war, mainly with the United States. It’s interesting to notice that, recently, on every attack on the gold price to push it down, once the original move stops, almost every time momentum fails to take gold lower. This pattern doesn’t look to me as a correction into a bear market but more as a bottoming formation.

Chart #1 : Spot Gold

This post was published at Gold Broker on Sep 23, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments