What’s Boiling Beneath the Surging Inflation?

What’s Boiling Beneath the Surging Inflation?

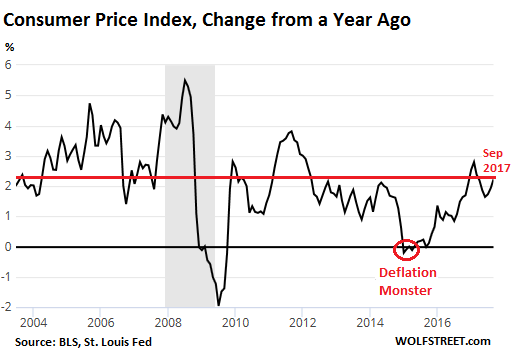

Consumers are going to shell out more money for the same stuff, that’s for sure. Inflation as measured by the Consumer Price Index jumped 2.2% in September compared to a year ago, the Bureau of Labor Statistics reported this morning. All fingers pointed at energy costs: the index jumped 10.1% year-over-year. Within it, ‘motor fuel’ prices (gasoline and diesel) jumped 19.2%.

Food prices rose 1.2% year-over-year, kept down by prices for ‘food at home’ – the stuff you buy at the grocery store – which inched up only 0.4% year-over-year in part due to the price war currently tearing into the supermarket sector.

In the chart below of CPI, note the dreadful ‘Deflation Monster’ – one of those rare and brief occasions in the US when the purchasing power of wages actually rose just a tiny bit on a year-over-year basis. It was caused by the energy bust. And it was ‘transitory’:

This post was published at Wolf Street on Oct 13, 2017.

Follow on Twitter

Follow on Twitter

Recent Comments