But now the first feeble reactions as stocks and bonds fall.

But now the first feeble reactions as stocks and bonds fall.

Here is what happened: The Fed has been tightening by raising rates and it has announced the unwinding of QE, with only the timing being still debated – whether at the September or December meeting – and financial conditions should be tightening in response, and the Fed wants them to tighten. But the opposite has happened. Markets have blown off the Fed.

Instead of tightening, financial conditions have been easing. Over the past few months, stock prices have surged, and bond prices have risen too, as longer-term yields have fallen and yield spreads have narrowed. Members of the policy-setting Federal Open Markets Committee (FOMC) have repeatedly lamented this disconnect at their last meeting in June. This became clear in the minutes of the meeting.

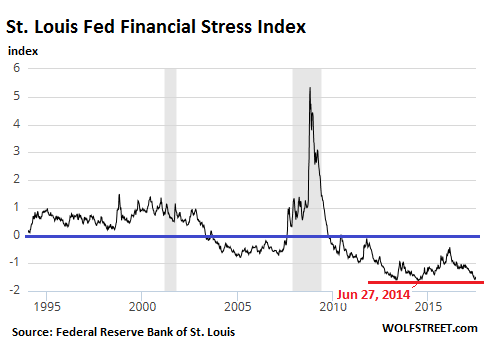

Today’s weekly update of the St. Louis Financial Stress Index shows this disconnect. The index – which indicates whether ‘financial conditions,’ as the Fed calls them, are easing or tightening – shows that financial stress barely budged off record lows (red line). In the chart, zero (blue line) indicates normal financial market conditions. Values below zero indicate below-average financial stress and easy financial conditions:

This post was published at Wolf Street on Jul 6, 2017.

Follow on Twitter

Follow on Twitter

Recent Comments