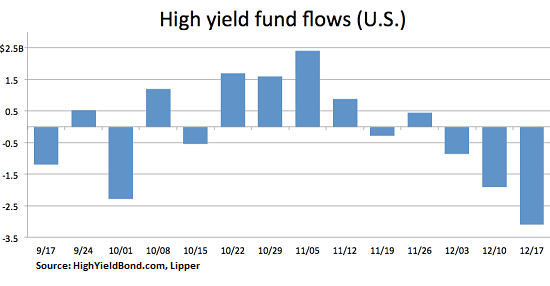

The phenomenal Fed-triggered feeding frenzy in stocks on Wednesday and Thursday was paralleled in the junk-bond market. Energy related junk bonds had gotten shredded over the past couple of months, as the price of oil has collapsed. The sell-off started spilling over to non-energy junk bonds. Tuesday, the day before the Fed’s announcement, junk bonds suffered their largest drop since October 2011. And just as all heck was breaking loose, and as yields were getting painfully high for our spoiled zero-interest-rate conditions, the Fed rode along once again to bail out the markets with its vague verbiage about being ‘patient.’

The phenomenal Fed-triggered feeding frenzy in stocks on Wednesday and Thursday was paralleled in the junk-bond market. Energy related junk bonds had gotten shredded over the past couple of months, as the price of oil has collapsed. The sell-off started spilling over to non-energy junk bonds. Tuesday, the day before the Fed’s announcement, junk bonds suffered their largest drop since October 2011. And just as all heck was breaking loose, and as yields were getting painfully high for our spoiled zero-interest-rate conditions, the Fed rode along once again to bail out the markets with its vague verbiage about being ‘patient.’

The markets interpreted this to mean whatever they wanted to: The stock market thought rates would stay at zero forever, sending stocks into a frenzy. The Treasury market thought rates would rise sooner than expected, sending 10-year Treasuries into a rout. And the junk-bond market had its own interpretation, in line with stocks, not Treasuries, unleashing the sharpest rally since August 16, 2011. It more than filled the hole left behind by Tuesday’s massacre and allowed junk bonds to end the week with a gain. Halleluiah, thank you Fed.

OK, it wasn’t enough. Over the two-week period, the average remains 157 basis points in the hole. And it’s down 536 basis points for the year. This chart of S&P’s High-Yield Corporate Bond Index, via LCD, goes back to the peak of the junk-bond bubble in June. Since then, junk bond values have dropped nearly 8%.

This post was published at Wolf Street on December 20, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments