Indubitably, there are several factors which heretofore have affected the price of gold. Needless to say, these factors have been material drivers that have fuelled the price of gold since the present secular bull market was birthed in 2001. Here are these gold price stimulating forces:

Indubitably, there are several factors which heretofore have affected the price of gold. Needless to say, these factors have been material drivers that have fuelled the price of gold since the present secular bull market was birthed in 2001. Here are these gold price stimulating forces:

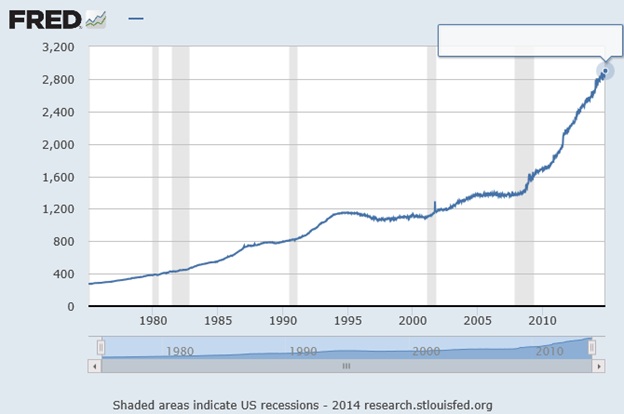

The bombing of New York’s World Trade Center September 11, 2001 (the infamous 911 event). Major World Central Banks accumulating gold reserves. Accelerated Growth in the US Fed’s Balance Sheet. China’s goal to diversity its overtly dangerous FOREX risk away from the US greenback. China’s covert objective to replace the US$ reserve currency with its own gold backed Renminbi. Central Bank gold price manipulation with a view to protect its fiat paper money policies. Accelerated growth in the US Money Supply. The following analysis will attempt to make a gold price prediction based solely on the last factor:

Accelerated Growth in the US Money Supply.

M-1 Money Supply

This post was published at Gold-Eagle on November 24, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments