12 Sep, 2014

12 Sep, 2014

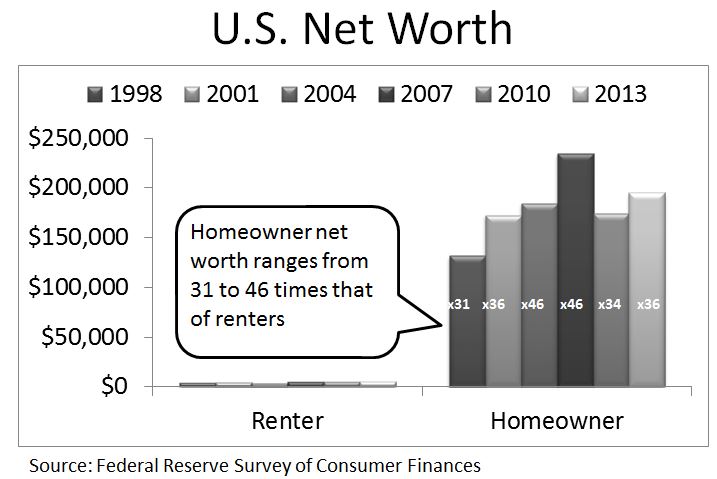

The nation is undergoing a radical transformation where renting is currently outpacing homeownership. The reasons are complex including the multi-year investor orgy into single family homes. Since the crisis hit 7,000,000 homes have been lost due to the long and drawn out process of foreclosure. No need to worry since investors picked up a solid portion of the slack here. Americans are notoriously bad savers and addicted to debt. For most, housing is a forced savings account. This is why when net worth data is pushed out we find that homeowners clearly outperform renters. It is important however to keep in mind most of the net worth is tied up in equity. That is, you will need to tap your home somehow to get the money flowing out. This is how we end up with dumpster diving baby boomers scrounging the local Whole Foods for goodies while living in amillion dollar crap shack. The hipster kids don’t seem to mind since they are now living with mom and dad, unable to afford the high rents in places like California. Yet housing overall does end up being a big forced savings account and that is why the net worth figures between homeowners and renters are not even close. If anything, it adds more evidence to the feudal landlord nation we are witnessing.

Net worth – homeowners and renters

One of the more in depth surveys done on net worth comes from the Federal Reserve. The data is comprehensive and shows a clear win for homeowners on the net worth front. In fact, as a nation, renters are one paycheck away from eating Kibbles ‘n Bits. Yet this doesn’t paint a very clear picture for say a place like San Francisco where the majority of households rent but you have tons of high paid tech workers.

First, let us examine the data:

This post was published at Doctor Housing Bubble on Dr. Housing Bubble /.

Follow on Twitter

Follow on Twitter

Recent Comments