There was a time when going to college made sense in every feasible way. It made sense professionally, economically, and many college graduates have a wonderful time in the process of completing their degrees. Most would argue that learning is vital in growing and moving forward. Yet students need to ask whether their return on investment is really worth it? Many people go to college in a compulsory fashion. This is simply the next step after high school. This was an easy decision to make during a time when the costs of going to college were affordable. Today, many schools charge $40,000 and $50,000 per year for a basic undergraduate degree. That is problematic. A large number of recent graduates are now working in positions that don’t require their specific field of study. In other words, they are employed in a field different from their undergraduate degree but still carry forward with mounds of debt. The total student debt market is now well over $1.2 trillion. It might be worth it to take a course in Student Debt 101.

There was a time when going to college made sense in every feasible way. It made sense professionally, economically, and many college graduates have a wonderful time in the process of completing their degrees. Most would argue that learning is vital in growing and moving forward. Yet students need to ask whether their return on investment is really worth it? Many people go to college in a compulsory fashion. This is simply the next step after high school. This was an easy decision to make during a time when the costs of going to college were affordable. Today, many schools charge $40,000 and $50,000 per year for a basic undergraduate degree. That is problematic. A large number of recent graduates are now working in positions that don’t require their specific field of study. In other words, they are employed in a field different from their undergraduate degree but still carry forward with mounds of debt. The total student debt market is now well over $1.2 trillion. It might be worth it to take a course in Student Debt 101.

Growing student debt

There are no signs or smells that the student debt bubble is likely to slow down in formation. To the contrary total student debt has been on a mission upwards in the last decade or so. When you saddle a nation of young people with mountains of debt don’t be surprised when first time home buying reverses or discretionary spending slows down. That seems to be another problem for another day in debt world.

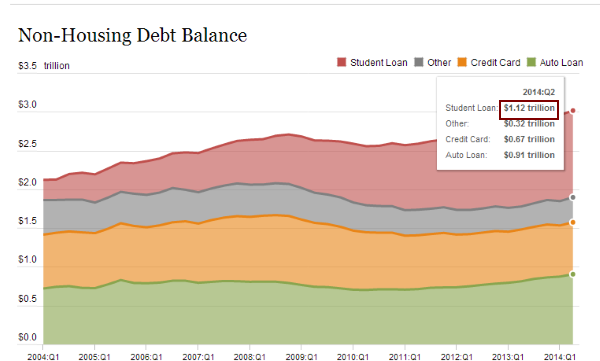

Student loan debt used to be a smaller part of non-housing related debt. Today it is now the largest consumer debt being held outside of mortgages. Take a look at the growth:

This post was published at MyBudget360 on September 1, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments